3 Must-Watch Tech Earnings Reports Coming Up

Three major players—Microsoft, IBM, and Amazon—are set to release their quarterly earnings reports, and all eyes will be on these updates to assess their growth, resilience, and ability to drive future trends.

These earnings reports are particularly important as they will reveal how these tech leaders are leveraging advancements in artificial intelligence, expanding cloud computing services, and navigating macroeconomic challenges such as changing consumer habits, monetary policy, and geopolitical uncertainties.

Investors will also be watching closely to see whether these companies can help sustain the rally in the U.S. stock market. Last week, the S&P 500 reached a new all-time high, marking a 23% year-to-date gain, while the Dow Jones closed above the 43,000 mark for the first time, signaling continued optimism about market growth.

According to Bank of America, as earnings season kicked off, 30 companies in the S&P 500 surpassed earnings expectations by an average of 5%, up from 3% at the start of the last quarter. An additional 41 S&P 500 companies reported results last week. However, with the S&P 500 currently trading at around 21.8 times forward earnings—well above its long-term average of 15.7—some analysts caution that stock valuations may be stretched. Any disappointment in these reports could trigger a market correction as investors reassess valuations.

As we look ahead to big tech’s upcoming releases, here’s what to watch for:

1# Will Microsoft’s Azure Unit Miss Expectations Again?

Microsoft delivered stronger-than-expected earnings and revenue for its fiscal fourth quarter, with total revenue rising 15% year-over-year. Net income climbed to $22.04 billion, up from $20.08 billion in the same quarter last year, translating to $2.69 per share.

While these results were solid, investor attention was focused on Azure’s performance, which fell below expectations for the first time since 2022. Azure and other cloud services posted 29% revenue growth, but this missed consensus estimates, sparking concerns about whether Microsoft’s cloud unit is losing momentum in an increasingly competitive market.

Despite the Azure miss, Microsoft’s management remains optimistic about future growth, suggesting potential acceleration in the coming quarters. However, investors remain cautious, as Azure’s performance is now a critical driver of Microsoft’s overall growth, especially as cloud computing continues to gain importance across industries.

As Microsoft prepares to release its fiscal Q1 2025 earnings on Tuesday, Oct. 22, after market close, all eyes will be on Azure once again. Analysts are forecasting a profit of $3.10 per share, with total revenue expected to dip slightly from $64.73 billion to $64.54 billion.

So far this year, Microsoft shares are up 12.75%, hovering around $418.

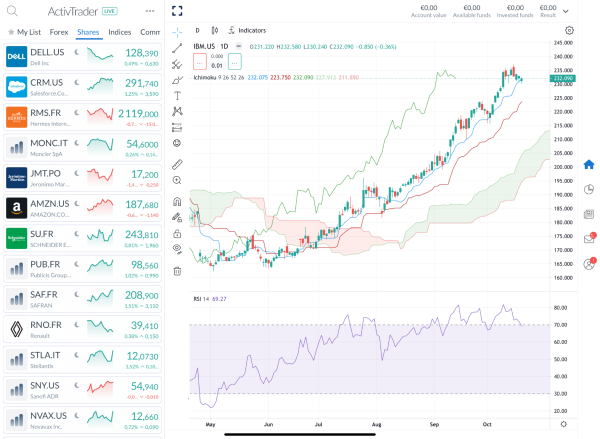

2# Can IBM’s Share Price Hit New Highs with a Strong Earnings Surprise?

IBM has made notable progress in its business, particularly with its focus on generative artificial intelligence, which played a key role in its strong performance last quarter. In its second-quarter earnings report from July, IBM exceeded analysts’ expectations, reporting a 1.9% revenue increase to $15.48 billion compared to the previous year. Net income also rose significantly to $1.83 billion, or $1.96 per share, up from $1.58 billion, or $1.72 per share, a year earlier.

Despite these gains, IBM faces several macroeconomic challenges, including higher interest rates, inflation, and geopolitical uncertainties, which may impact its growth. Still, the company remains confident in its tech-driven approach, particularly in AI and cloud computing, which it believes will fuel future success.

As IBM prepares to release its Q3 2024 earnings on Wednesday, Oct. 23, investors are eager to see if the company can once again exceed expectations. Analysts forecast a slower profit of $2.22 per share, down from $2.43 in the previous quarter, and a slight revenue dip from $15.77 billion to $15.06 billion. If IBM delivers a strong performance—boosted by AI adoption or robust hybrid cloud growth—it could reignite investor confidence and push the share price to new highs.

So far this year, IBM shares are up 43.78%, hovering around $232.

3# Is Amazon Still Losing Ground to Its Peers?

Amazon reported softer-than-expected revenue for the second quarter, alongside a disappointing forecast for the third quarter. Net sales grew 10% year-over-year to $148.0 billion, up from $134.4 billion in the same period last year, but fell short of the $148.56 billion projected by analysts at LSEG. Despite the revenue miss, Amazon saw a significant boost in profitability, with net income climbing to $13.5 billion, or $1.26 per diluted share, compared to $6.7 billion, or $0.65 per diluted share, a year ago.

The underwhelming revenue performance is largely attributed to sluggish growth in Amazon’s core retail business, where competition from discount platforms like Temu and Shein has intensified. These rivals, which allow Chinese merchants to sell low-cost products to U.S. consumers, are eating into Amazon’s market share. Sales in Amazon’s online stores segment grew just 5% year-over-year, reflecting consumers opting for cheaper products and leading to a decline in the company’s average selling price (ASP).

On the cloud front, Amazon Web Services (AWS) performed well, growing 19% year-over-year and generating $26.3 billion in revenue, surpassing estimates of $26 billion. However, AWS is expanding at a slower pace compared to its major competitors, Microsoft and Google, whose cloud divisions are growing more rapidly.

As Amazon looks ahead, the company faces the challenge of balancing slow retail growth with rising competition in both e-commerce and cloud computing, adding pressure to innovate and find new growth opportunities in the next quarter.

So far this year, Amazon shares are up 26.05%, hovering around $188.

Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 66% and 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ActivTrades Corp is authorised and regulated by The Securities Commission of the Bahamas. ActivTrades Corp is an international business company registered in the Commonwealth of the Bahamas, registration number 199667 B.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.