A BoE rate cut is expected but the overall rhetoric matters – Preview

- The BoE meeting concludes on Thursday

- Market expects a 25bps rate cut

- Rhetoric and voting pattern matter

- Pound could suffer from a dovish rate cut

BoE meets on Thursday

The Bank of England will hold its penultimate meeting for 2024 on Thursday, a few hours ahead of the Fed's gathering. With the market anxiously awaiting the outcome of the US presidential election, Governor Bailey et al will examine the progress made since the September meeting.

Mixed signals from the economy

Since the September meeting, economic data releases have been mixed. The headline inflation rate dropped below the 2% level, mostly due to favourable base effects, but core inflation remains north of 3%. Similarly, services inflation eased to 4.9% in September, the lowest rate since May 2022, but remains very elevated.

Meanwhile, unemployment is near record low levels and retail sales continue to strengthen. The retail sales indicator that excludes fuel spending rose by 4% in September, partly reflecting the strong average earnings growth during 2024, although the latter has shown signs of weakness lately.

The most alarming signal comes from the PMI surveys. Both the Manufacturing and Services surveys have been weakening, raising concerns about the short-term outlook of the UK economy.

Autumn budget impact

The Autumn Budget 2024, announced on October 30, was dominated by tax increases. The new government is planning to raise £40bn in extra tax revenue, and spend most of these funds on updating public services. While the independent Office for Budget Responsibility (OBR) published fabourable GDP forecasts, the actual impact on the UK economy remains uncertain, particularly due to the national insurance changes.

Interestingly, the quarterly projections will be released on Thursday. The BoE has already announced that any changes in fiscal policy resulting from the Budget will be incorporated in the November projections. Therefore, it will be interesting to see how the BoE evaluates the impact of these tax increases.

Bailey et al face a true challenge

Putting everything together, the MPC will need to balance domestic developments and a volatile external environment. The economy is probably losing steam as portrayed by the PMI surveys, with the UK budget announcement potentially muddling the economic outlook rather than proving beneficial.

The market is confident that a 25bps rate cut will be announced on Thursday. Despite repeated comments from certain BoE hawks for a gradual approach, it seems that Governor Bailey will achieve the necessary majority to get the rate cut approved.

Apart from the decision, the market’s focus will also be on the overall rhetoric of the meeting, including the press conference. At this stage, it makes sense for the BoE to remain balanced and avoid adopting a more dovish tone. Such a strategy could secure broader support for the rate cut and avoid a repeat of the 5-4 split vote at the July 31 gathering.

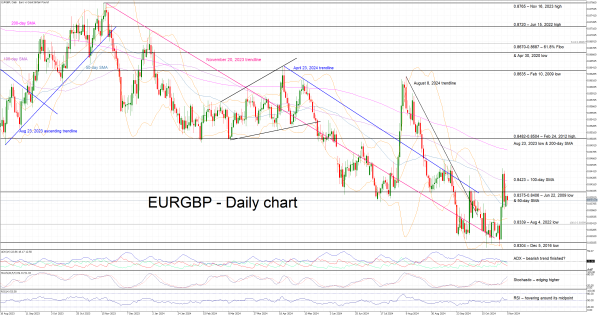

Pound could suffer against the euro

October was a relatively tough month for the pound, as the October 30 budget shocked pound bulls, leading to a sizeable underperformance against both the euro and the dollar.

While the euro is enjoying a brief spell of positive data prints, Thursday’s BoE meeting could reverse the recent euro/pound trend upleg. A rate cut accompanied by balanced rhetoric and a 5-4 split vote could further reduce the chances of back-to-back rate cuts in December, potentially boosting the pound.

On the flip side, a dovish rate cut with strong support could open the door to another rate cut in December. In this scenario, the pound could suffer, with euro/pound potentially climbing decisively above the 100-day simple moving average at 0.8423.