A desire for Greatness

As we embark on H.G. Wells’ time machine, we can see that gold has always fascinated across continents, eras and civilizations. From the Incas in South America to Mansa Moussa in Mali and Ancient Rome, this precious metal has created and maintained an important link between the earth and human beings, often arousing envy.

In 2004, the price of gold was 400 dollars an ounce* 1300 dollars an ounce in 2014, and today we’re at around 2500 dollars an ounce. Prices have risen 6-fold in 20 years, and the appetite for this precious metal continues unabated.

For the vast majority, gold is a safe investment in a context of geopolitical and financial instability, and increased tax pressure on liquid savings or those invested in securities on the financial markets.

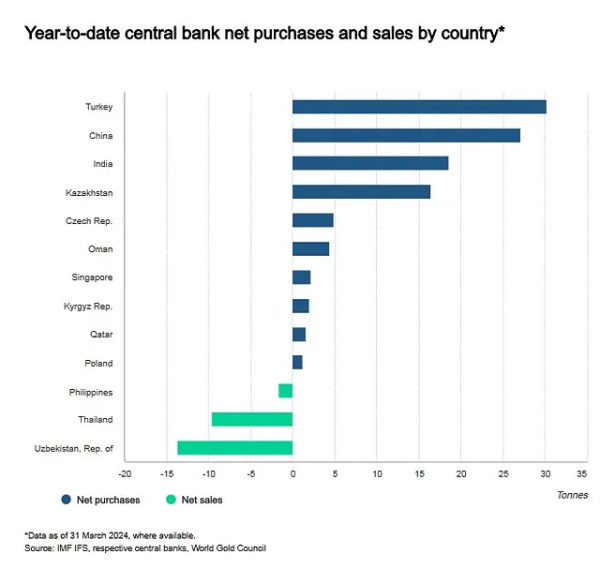

Demand is very strong from China and India. The latter, considered to be “continent countries”, have cash to invest from their trade surpluses, and are opting instead to invest it significantly in metal. The central banks of Turkey, China, India and Kazakhstan together represent the world’s largest buyers of gold.

- 1 ounce =31,1 grams

We note that since 2022, some emerging countries have slowed down their dollar-denominated investments in favor of gold. This is due to the situation in Ukraine and the sanctions imposed on Russia.

Assets and economic resources of Russian individuals, companies and entities have been frozen. Other countries could be targeted, as these financial sanctions could set a precedent and lead these same countries to whet their appetite for the yellow metal.

The spectre of conflict between China and Taiwan is a major catalyst for the Chinese central bank to strengthen its gold positions. Turkey’s inflationary economic context and its support for Azerbaijan in its conflict with Armenia over the Nagorno-Karabakh region are also prompting the Turkish government to diversify its investments.

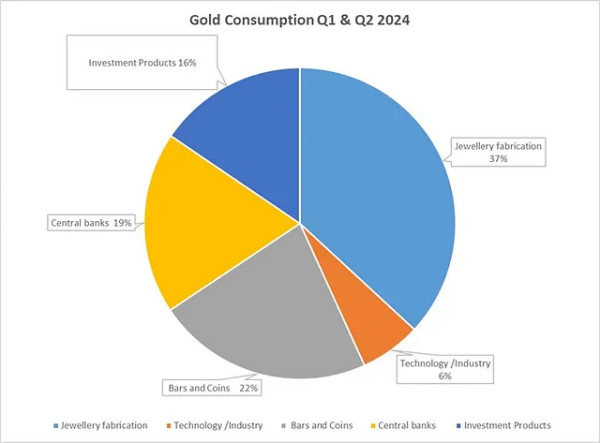

Other factors also explain this rush to GOLD 2.0. Indeed, the metal’s use is not limited to jewelry, even if that alone accounts for 30%.

Gold is an excellent electrical conductor, a quality required by smartphones for fast data processing.

Assuming that a Smartphone can contain up to 0.034g of gold, you would need 10,000 iPhones to obtain 340g of gold.

Faced with this growing demand, some European jewelers have lowered the quality of the gold they sell. For a very long time, 18-carat gold (18g of gold for 24g of alloy) was the usual choice. Today, the focus is on the more affordable 14-carat, which became very popular and widely marketed in the USA in the 90s.

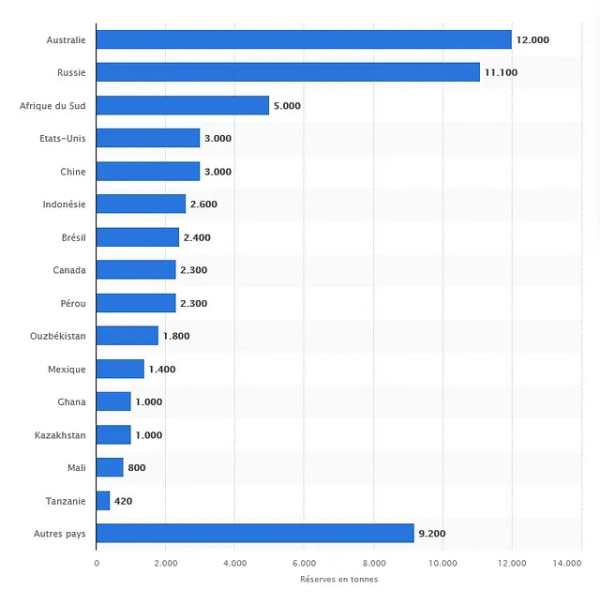

According to the latest studies published by the World Gold Council (WGC), an association of the world’s leading gold producers, it is estimated that 80% of the earth’s reserves have been extracted since the beginning of gold mining, some 6'000 years ago.

Intensified production has led the WGC to estimate that 60'000 tonnes of natural gold reserves are still available, which means that mining could continue until 2050. This intensive, water-intensive production undeniably has an environmental impact, and ESG criteria are being challenged in order to achieve more responsible mining.

Geopolitical instability and the mistrust of certain states towards paper money, accompanied by sheep-like investment, lead private individuals to buy the asset that is most extolled in the mainstream and specialist press.

Gold’s evolution over the last few decades is a testament to the adage: “What’s rare becomes expensive”. FOMO* takes on its full meaning here: investors are afraid of having missed the train, and of standing on the platform watching other trains go by without daring to get on.

Reflexes change and habits evolve. Alongside traditional purchases of “physical” gold, there has been a marked increase in investments in the precious metal through stock market products such as ETFs, or other more speculative solutions such as CFDs with increased purchasing capacity through the use of leverage.

* « Fear Of Missing Out »

The global context characterized by existing or latent conflicts, leading to mistrust of paper currencies against a backdrop of falling interest rates from the world’s central banks, still leaves room for a marked appetite for the yellow metal.