A good old-fashioned risk on rally

A Fed offering a message of control, married with a convincing appetite to support the US labour market, sent the reassuring message the market craved as a signal to add risk into the portfolio. Add in, the opaquer flow-based effects, with momentum-focused players buying equity in alignment with the positive price action, options dealers hedging exposures and active managers fearing underperformance and the result has been some impressive gains in all parts of the risk spectrum.

Preview

PreviewUS big tech, comm services and consumer discretionary dominated the buying flows, with solid gains seen in Nvidia, Meta, Tesla, Microsoft, and Apple. Defensives underperformed, with staples, utilities and REITS lower on a day when 70% of S&P500 stocks closed in the green. Volumes were solid, with S&P500 cash volumes 15% above the 30-day average.

So, some solid moves played out - however if I had played the pessimist, I would look to Nvidia and the intraday price action. Granted, longs will always take a gain of 4%, but the intraday price action lacked conviction, with the price hitting $119.66 mid-way through the session, before bleeding 1.5% off the high into the close. The NAS100 cash hit a high of 19,951 but also tailed off into the back end of trade. And while the S&P500 cash closed at a new ATH, the session high to low trading range of 47 points was below average, where I would have liked greater range expansion and the index closing closer to the highs to really convince me. S&P500 futures, while also hitting a new ATH of 5737.50, failed to hold above the former ATH of 5721.25 set in July.

The question then is whether the positive sentiment and feel-good factor can build, especially with ‘triple witching’ the mix in the US session ahead – here, talk of over $5t of single stock, S&P500 futures, and S&P index quarterly options expiring today, and this factor alone can create significant flow based effects, which to those not aware of the event, may find it hard to reconcile the price action relative to the news flow.

The positive flows weren’t just an equity phenomenon, with crude +1.6%, copper +1.1%, gold +1.1%, US HY credit 8bp tighter, and in FX the USD has been offered, and notably the higher beta plays - NOK, AUD, BRL, and GBP. Granted, all four currencies were impacted by central bank meetings, or in the case of the AUD robust labour market data, but the buyers have been in control – GBPUSD attracting big client flow and notably through the August highs of 1.3266, where the spot rate is closing out the session at the highest level since March 2022.

Preview

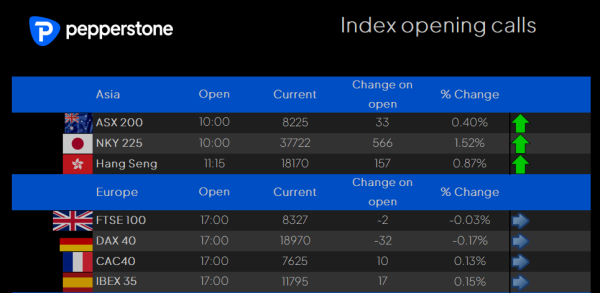

PreviewTurning to Asia our calls look promising as we close out the last trading day of the week. The NKY225 is poised to build on the 2.1% rally we saw yesterday, where both equity and JPY traders will be looking out for national CPI figures (at 09:30 AEST), and BoJ governor Ueda’s speech that follows the BoJ meeting in afternoon trade. The BoJ meeting will likely be a non-event for markets, but Gov Ueda’s speech could have an impact. The ASX200 is called to open firmly above 8200, so we’ll see if funds and traders look to chase the opening strength, or whether we see sellers offload exposures feeling this move is a little too hot – either way, a daily close firmly above 8200 is the clear target.

Good luck to all.