A new currency tries to defy conventional wisdom

The world of currencies is like this long and riveting journey which sees a constant addition and deletion of travellers (read currencies). In this voyage, Caribbean Guilder is the newest currency off the block. Richard Doornbosch, the President of the Central Bank of Curacao and Sint Maarten, just announced the new common currency in a speech.

Curacao and Sint Maarten are two tiny island countries in the Caribbean Sea. Both have a long history of colonization and were part of Kingdom of Netherlands. In 1954, the countries were decolonized but remained part of the Kingdom. They were also renamed as Netherlands Antilles. In 2010, referendums were held and the two countries voted to become independent countries but remained within the Kingdom.

Road to a common currency

Before becoming autonomous, the two countries (along with other members of the Kingdom) used a currency called as Netherlands Antillean Guilder (NAf). It was pegged against US Dollar. The peg was fixed at 1.79 per US dollar in 1971 and remained fixed at that rate.

In 2010, as the two countries became autonomous discussions began on introducing a new currency. Currency after all signifies monetary independence and is an important aspect of nation building. The countries decided to replace the old curency with Caribbean Guilder but it took 14 years before it could be launched in 2024, and will take another year before it is finally introduced in the economy in 2025.

Why did it take so long? Doornbosch explained: “At that time there were sufficient Netherlands Antillean banknotes and coins in stock, and many felt that creating a new currency whilst the existing currency was working seemed a waste of time, effort and resources.”

However, over time there was a need to move to a new monetary system. The authorities debated whether they should adopt US dollar as a currency? After all, NAf was pegged to US dollar and dollarization would be easier.

Cost-benefit of dollarization

The authorities commissioned a study on dollarization with the International Monetary Fund (IMF).

IMF released its assessment report in 2021. The report noted both benefits and costs of dollarization. One major benefit of dollarization is that as one adopts US Dollar as a currency, the monetary policy of the country is driven by the US Federal Reserve. There is a belief that it will do a better job compared to a central bank of a small economy.

Other benefits are elimination of the currency risk, lower transaction costs, higher policy credibility and higher investor confidence promotes investment and growth. The costs are loss of independent monetary policy, very limited power to provide liquidity during financial crises, and loss of seigniorage.

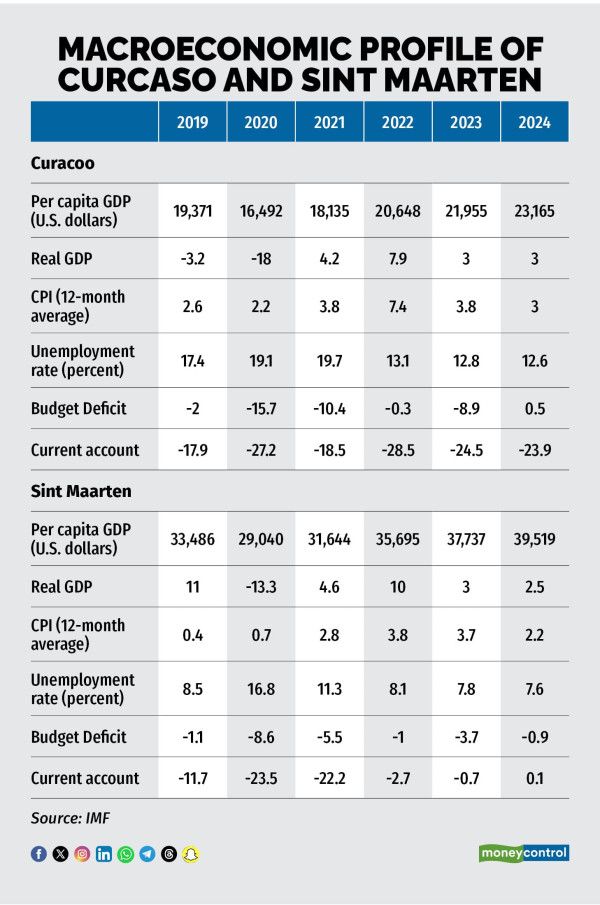

The report noted that whether the two countries adopt dollarization or a new currency, they will need significant reforms. Even though both the countries are mainly tourism-oriented, there are significant differences in economic profile of the two countries. On analysing the macroeconomic data of last few years, we see Sint Maarten’s macroeconomic profile is much better placed than that Curacao.

The per capita income is nearly double in Sint Maarten and it also has lower unemployment rates and currency account deficit. The economic differences is explained by the different economic structure of the two economies. This makes Curaçao and Sint Maarten vulnerable to differential shocks in addition to the common global shocks such as the 2020-21 pandemic.

Despite these large economic differences, the authorities weighed between dollarization and a new common currency, and opted for the latter. This is odd as we now have both economic theory and evidence to show that for currency unions to work, we need special conditions.

Conditions for a successful currency union

Economist Robert Mundell had argued that in a currency union, member economies do not have their own monetary and fiscal policy help them recover from the shocks. In case of a currency union, the monetary policy is conducted by a common central bank which cannot respond to individual country shocks. Even fiscal policy cannot react to shocks as under a monetary union, fiscal policy has to be responsible otherwise the union breaks down. Thus in monetary unions, you need high labour mobility so that people can migrate from the affected region to the other not so impacted region. Apart from labour mobility, one needs high integration of trade and capital as well.

In the case of Eurozone, we did see this theory play out. The members had high capital and trade mobility but not enough labour mobility. The member economies also had irresponsible fiscal policy. and had high budget deficits. Post-2008 global financial crisis, these economic divides were deeply exposed and the region moved from one crisis to another.

In the case of Curacao and Sint Maarten, the IMF review points that though there is high labour mobility but there is limited trade and capital mobility. Also, Curacao has weak macroeconomic fundamentals.

To sum up, while it is interesting to see introduction of a new currency named Caribbean Guilder, history and evidence of currency unions suggest that hard work would be needed to make this new currency run off the block.