A Traders’ Week Ahead Playbook – After a bruising week we fight on

Some who weren’t dynamic to the volatility, and the multi-sigma moves, would be reevaluating their strategy, their execution and overall approach. While others would have seen the extreme price action as a prosperous hunting ground to play out their edge. They will be hoping for a re-run of the liquidations that caused such distorted pricing in certain markets, with many tactical and technical clients buying risk into the extremes and when the sound of cannons was deafening.

This is a new week though, and for those feeling a sense of invincibility, this is where the psychology of trading kicks in - where after a bout of form traders need to remove emotion and ego, as the market will throw up a whole set of challenges and behaviours. That means being on top of one’s game, where the price-focused traders need absolute clarity to execute edge without any recency bias.

I fully subscribe to the view that the market will go to where it wants to go, and its flow, liquidity and sentiment that drive short-term market moves. Where we as traders weigh up the probabilities of a directional move and execute when we see a skew in direction that offers a positive expectancy.

Economic data, central bank meetings/speeches and company earnings guidance often result in short-term volatility, but the most important aspect is how the outcomes feed the evolving macro narrative.

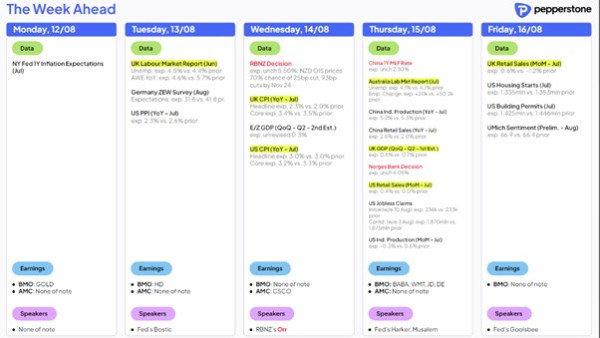

The event risks that could move markets this week

With the overriding macro theme being the pricing the probability of a US recession over the coming 4 quarters, amid a synchronized global growth slowdown, one would argue that broad markets will be most sensitive to any data points that offer clarity around consumption trends, consumer spending patterns and inputs that feed into the GDP calculation, with sensitivity also expressed on labour market data.

After last Friday’s US nonfarm payrolls report, the extreme negative sentiment saw US interest rate markets and bond markets pricing not just a slowdown but an impending growth shock scenario. While some traded these extremes with precision, we can all look back now and see the pessimism was grossly overdone, and subsequently many of the doomsday calls and deep recession trades have been pared back.

However, the market is still on edge and would look to reengage with recession trades, with cries that the Fed are ‘behind the curve’ if the data shows further softening.

US Rates Review – Market pricing for Fed policy for upcoming meetings

Preview

PreviewUS CPI and retail sales are the highlights this week

Looking at the calendar this week the US NFIB Small Business Optimism (Tuesday), US CPI and US retail sales (Thursday) stand out as having the potential to influence sentiment and markets.

The US retail sales print is expected to increase 0.4% m/m, with the retail sales ‘Control Group’ element – that is, the inputs that are less volatile and feed most directly into the GDP calculation – expected to print +0.1% m/m. A negative read, therefore, could feed the macro focus of an economic slowdown and could see increased anxiety in markets. A hotter print could see US recession bets walked back further, with the USD rallying concurrently with equity.

Preview

PreviewThe US CPI Playbook

The US CPI print (due Wed 22:30 AEST) will be seen by some as the marquee event risk, and when considering the possible playbook around the market reaction, I would focus on the core month-on-month CPI print:

Above 0.35% m/m – US interest rate swaps would reduce expectations for easing at the September FOMC meeting towards 25bp-30bp, with the USD rallying vs all G10 currencies, and the NAS100 and gold likely trading lower. The cries of ‘stagflation’ may be heard more liberally.

Between 0.2% m/m - 0.3% m/m – While the Fed have recalibrated their inflation focus to an equal consideration with the labour market, a print below 0.25% m/m may see relief buying of risk markets and modest USD selling - where the move in markets will be determined by market positioning.

Below 0.2% m/m – US interest rate swaps would likely price 40bp of cuts for the September FOMC meeting, with the USD trading lower, and NAS100 and gold seeing further relief buying.

US corporate earnings come in heavy, but again there are no major names which could impact broad market sentiment. However, given the focus on US consumption patterns, one could argue that guidance from the likes of Home Depot (Tuesday) and Walmart (Thursday) could offer important insights on US economic trends and are worth having on the radar.

UK jobs and CPI a risk for GBP traders

Outside of the US and GBP traders will react to UK jobs (Tuesday), and UK CPI inflation (Wednesday), where the consensus forecasts UK core CPI to fall a tick lower to 3.4%. With UK interest rate swaps pricing the probability of a further 25bp cut at the 19 Sept BoE meeting at 40%, the inflation print may influence expectations of easing here, and may lead to some volatility in the GBP.

Aussie jobs and ASX200 corporate earnings get the focus

In Australia, we hear from RBA Deputy Andrew Hauser (Today at 12:00 AEST), although his views should fall in line with last week's comments from Gov Bullock, so shouldn’t move the AUD to any great degree. The July employment report (Thursday 11:30 AEST) has the potential to impact the AUD, although it would need to be an outsized miss/beat to radically alter Aus swaps pricing, which currently sees a 50/50 probability that the RBA ease in the November meeting.

Preview

PreviewFor Aussie equity and AUS200 index traders, we see some big names reporting FY24 earnings through the week – JBH, CSL, CBA and Cochlear are the marquee plays to put on the radar.

CBA earnings preview (Before market on Wednesday) – ASX200 earnings reports don’t come much more important than those of CBA, given they hold the biggest index weighting on the ASX200 and are a true bellwether. The analysts’ consensus is for FY net interest margins to come in at 1.98% (vs FY23 of 2.07%), FY24 cash earnings at $9.77b (FY2023 $10.09B), paying a FY div of $4.57 (2H24 div per share of $2.40). As always, there will be great focus on costs, asset quality, liquidity, and commentary on the demand for lending, and Australian economic trends. The options market prices a -/+2.6% move in the share price on Wednesday, where an outsized move in the share price will drive the ASX200 financial sector and impact the ASX200.

Can the HK50 index finally break the multi-month downtrend?

Preview

PreviewStaying on the earnings vibe, we get important corporate earnings out of HK/China, with numbers from Tencent, Alibaba, and JD. Com likely to get an increased focus from clients. These earnings put the HK50 index in the spotlight, where the daily timeframe shows the index falling in a pronounced bear channel since mid-May. Subsequently, the bulls need to find some real inspiration to convince the index could break the trend of lower highs and lows.

Traders will also be watching the data from China this week, with July credit data, home prices, industrial production, retail sales and property sales in the mix and where weaker numbers may impact sentiment towards cyclical or growth-sensitive assets (such as the AUD or copper).

A 25bp cut from the RBNZ is a coin toss

By way of central banks, we see the RBNZ meeting on Wednesday, with NZ swaps pricing a 72% implied probability of a 25bp cut, while economists are split with 12/25 calling for rates to be left at 5.5% - this implies some degree of volatility in the NZD mid-week. We also see the rates decision from the Norges Bank (due Thursday at 18:00 AEST), although no one expects a change in rates here, it does pose some risk to those holding NOK (Norwegian krone) positions.

So, it’s another big week ahead for traders – where, after a solid turnaround on Tuesday in risk assets (such as equity), we ask whether the upside momentum can build. The answers will likely come from the data flow, so stay nimble and react without hesitation.

Good luck to all.