A weaker Dollar drives gold higher

Gold prices have returned above $US2000 per ounce. We run through the factors driving gold and the commodity’s key technicals.

Lower yields support gold, but correlation weakens

A reversal in real yields has removed a headwind to gold prices. However, the correlation between gold and real yields has broken down, suggesting that they are a smaller factor in the commodity’s recent rally. The daily correlation between the 10-year real yield and gold has fallen to around 0.2, down from 0.7 in September.

(Source: Bloomberg)

Past Performance is not a reliable indicator of future results.

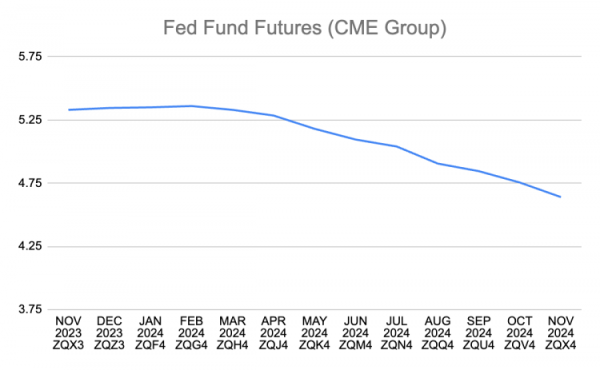

Nevertheless, weaker US economic data and expectations of an unfolding slowdown in economic growth have led the markets to price in a peak in US interest rates and, eventually, rate cuts next year, which has been one-factor driving gold prices higher.

(Source: CME Group)

What is your sentiment on Gold?

2021.68 Bullish or Bearish Vote to see Traders sentiment!Market sentiment:

Bullish Bearish

66% 34%

You voted bullish.

You voted bearish.

Give Gold a try

Start trading Start trading Start trading or Try demoGeopolitical risk premium diminishes on Israel-Hamas ceasefire

The breakdown between real yields and gold prices came following the onset of the Israel-Hamas war, with the markets pushing the metal to discount a geopolitical risk premium. However, the war has diminished as a driver of gold, with a ceasefire between combatants this week easing tensions in the region and reducing the precious metal’s safe-haven appeal.

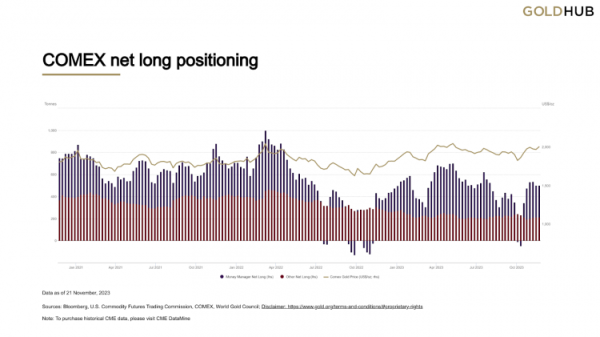

Gold long positions remain flat for a second week

Despite the rise in gold prices, positioning in the futures market has remained unchanged for a second consecutive week. The trend points to no additional speculative demand for the commodity; however, with net long positions relatively low by historical comparisons, ample buyers are arguably waiting on the sidelines to push gold higher.

(Source: Comex)

A weaker Dollar boosts gold prices

Lately, the primary driver of gold has been a weaker US Dollar, which has provided a broad mechanical uplift in commodity prices. The Dollar has fallen as markets price out future US Fed hikes in response to softening economic data and subsequent expectations of deeper rate cuts next year. A spate of critical US data is released this week, including preliminary GDP figures, PCE Index data, and the ISM Manufacturing survey.

(Source: Trading View)

(Source: Trading View)

Past Performance is not a reliable indicator of future results.

Gold trends higher ahead of a critical resistance level

Currently, gold prices are predominantly a factor of the US Dollar, so price action in gold could be determined by the movement of the Greenback. From a technical standpoint, gold is in an upward trend channel with momentum skewed higher. Upward-sloping trendline support could draw buyers. Meanwhile, a resistance zone sits around $US2005 and $US2010.

(Past performance is not a reliable indicator of future results)