All you need to know about the upcoming 20-year US Treasury auction.

Summary:

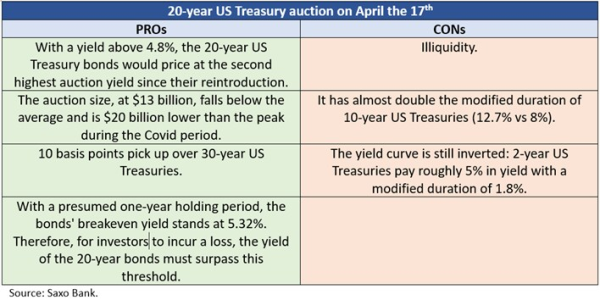

- The auction is likely to benefit from the second highest auction yield on record, a below average auction size and a reasonable pick up over 30-year US Treasury.

- Recent bearish bond sentiment, coupled with the illiquidity inherent in this maturity, and an inverted yield curve - where 2-year US Treasuries yield close to 5% - collectively present challenges to demand.

- A stop-through is probable should bonds continue to sell off tomorrow.

- Regardless of the auction results, 20-year yields are likely to continue to soar toward 5%. To reverse this bullish trend a close below 4.42% is required.

As bond markets experience a widespread sell-off across various tenors, the US Treasury is gearing up to auction $13 billion worth of the infamous 20-year bonds (US912810TZ12) on Wednesday.

The 20-year maturity stands out due to its notorious illiquidity within the US yield curve. Reintroduced in May 2020 during the Covid pandemic to bolster the US Treasury's debt-raising efforts, it had been discontinued in 1986. This explains why it offers a substantial yield pick up over 30-year bonds, approximately 10 basis points higher.

Let's delve into the advantages and drawbacks of the upcoming 20-year US Treasury auction to ascertain whether weak bidding metrics might accelerate the uptick in yields.

Interesting takeaways from previous US Treasury auctions:

- Tails in the 20-year tenor are less common compared to 10- and 30-year auctions. Since May 2020, the 20-year high-yield tailed when-issued only 21 times over 47 months. In contrast, the 30- and 10-year auctions tailed 25 and 28 times respectively. This discrepancy is likely because the auction size for the 20-year tenor has not been increased to record-high levels, as seen with the 10-year US Treasury auctions.

- Last October, the 20-year bond auction stopped through when-issued as US Treasury yields were rising broadly. A similar scenario might unfold again, as investors seek to lock in one of the highest yields seen in over fifteen years.

Yield levels to watch out for:

US 20-year Treasury yields are currently trading around the 0.618 retracement at 4.88. The trend is bullish supported by RSI indicating 20-year yields are likely to move higher towards the 0.786 retracement and resistance area at around 5.05-5.20. To reverse this bullish trend a close below 4.42 is required. (Courtesy of Kim Cramer Larsson)

Other recent Fixed Income articles:

16-04 QT Tapering Looms Despite Macroeconomic Conditions: Fear of Liquidity Squeeze Drives Policy

08-Apr ECB preview: data-driven until June, Fed-dependent thereafter.

03-Apr Fixed income: Keep calm, seize the moment.

21-Mar FOMC bond takeaway: beware of ultra-long duration.

18-Mar Bank of England Preview: slight dovish shift in the MPC amid disinflationary trends.

18-Mar FOMC Preview: dot plot and quantitative tightening in focus.

12-Mar US Treasury auctions on the back of the US CPI might offer critical insights to investors.

07-Mar The Debt Management Office's Gilts Sales Matter More Than The Spring Budget.

05-Mar "Quantitative Tightening" or "Operation Twist" is coming up. What are the implications for bonds?

01-Mar The bond weekly wrap: slower than expected disinflation creates a floor for bond yields.

29-Feb ECB preview: European sovereign bond yields are likely to remain rangebound until the first rate cut.

27-Feb Defense bonds: risks and opportunities amid an uncertain geopolitical and macroeconomic environment.

23-Feb Two-year US Treasury notes offer an appealing entry point.

21-Feb Four reasons why the ECB keeps calm and cuts later.

14 Feb Higher CPI shows that rates volatility will remain elevated.

12 Feb Ultra-long sovereign issuance draws buy-the-dip demand but stakes are high.

06 Feb Technical Update - US 10-year Treasury yields resuming uptrend? US Treasury and Euro Bund futures testing key supports

05 Feb The upcoming 30-year US Treasury auction might rattle markets

30 Jan BOE preview: BoE hold unlikely to last as inflation plummets

29 Jan FOMC preview: the Fed might be on hold, but easing is inevitable.

26 Jan The ECB holds rates: is the bond rally sustainable?

18 Jan The most infamous bond trade: the Austria century bond.

16 Jan European sovereigns: inflation, stagnation and the bumpy road to rate cuts in 2024.

10 Jan US Treasuries: where do we go from here?

09 Jan Quarterly Outlook: bonds on everybody’s lips.