Alphabet Q3 earnings: what to expect?

Alphabet Q3 earnings date

Alphabet Inc - Ger, the parent company of Google, is set to release its third-quarter 2024 earnings report on October 29th, 2024, after US markets close.

Alphabet Q3 earnings expectation

EPS: EST $1.84, representing a 18% increase from Q3, 2023

Revenue: EST 86.23B, up 10% from the year-ago quarter

It’s worth noting that Alphabet Inc - Ger has consistently double-beaten Wall Street’s projections for both EPS and revenue over the past four quarters. In Q2, the tech giant reported an EPS of $1.89, exceeding the anticipated $1.84.

Alphabet Q3 earnings key watch

Cloud and advertising

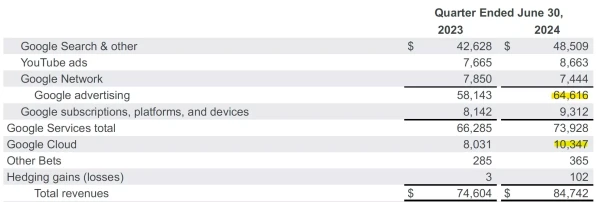

The strong demand and growth from cloud services have driven Alphabet’s impressive 14% year-over-year growth in the recent quarter. This division saw a remarkable 28% increase in quarterly revenue, surpassing $10 billion for the first time.

In contrast, Google's advertising business—the cornerstone of its revenue—has been growing at a slower pace in recent quarters. Investors will be keen to evaluate how the company’s advertising revenue has performed amid economic uncertainties and intensified competition from rivals like Meta Platforms Inc.

AI

Despite the waning AI frenzy, investors are eager to learn about Alphabet's advancements in AI integration across its platforms and the resulting technical synergies. Beginning in Q2, Alphabet consolidated the teams of Google Research and Google DeepMind to concentrate on developing AI models and accelerating integration efforts. Any positive update from this newly formed AI Plus division is likely to boost investor confidence in Alphabet's outlook for future tech.

Concerns

Despite reporting stronger-than-expected Q2 earnings, Alphabet's stock price dipped on the previous earnings date (July 24th), primarily due to its conservative forward guidance, which resulted in a 5% decline in a single day.

Additionally, concerns grew regarding the returns from the tech giant's significant investments in artificial intelligence. As of June 30, Alphabet's research and development expenses had risen to $23.8 billion, up from $22.05 billion in the same quarter last year.

Alphabet share prices

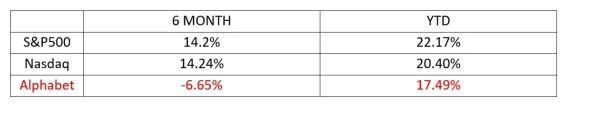

Compared to benchmarks like the broader S&P 500 and Nasdaq indexes, Alphabet Inc - Ger,share price has underperformed over the past two quarters and year-to-date.

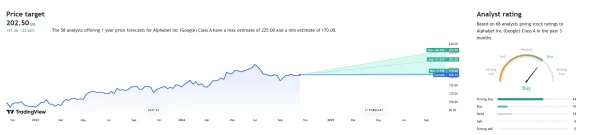

However, analysts maintain a generally positive outlook for Alphabet shares. According to TradingView, 44 out of 67 analysts have assigned the stock a "strong buy" rating, with no analysts recommending a sell.

In terms of price targets, the average one-year projection from 58 analysts stands at $202, indicating a 22% increase from the closing price of $165 on October 22, 2024.

From a technical standpoint, as of October 22nd, the price has risen to test the descending trendline established since July. A breakout above this critical resistance could pave the way to the early October peak at $168 and the 100-day simple moving average (SMA) around $169.

Conversely, failing to surpass this major hurdle heightens the risk of losing current support, potentially resulting in a decline toward the 200-day SMA, located in the $160-$161 range. A drop below $160 would position the price under all major moving averages, indicating a potential bearish shift.

Conclusion

Alphabet Inc - Ger Q3 2024 earnings report is poised to provide deeper insights into the search engine king’s financial vitality and future prospects. Investors will closely examine critical areas like advertising, cloud services, and AI advancements, all while reflecting on the intriguing dance of its share price movements. With heightened scrutiny, this report promises to shed light on how well Alphabet is navigating the complexities of the tech landscape.