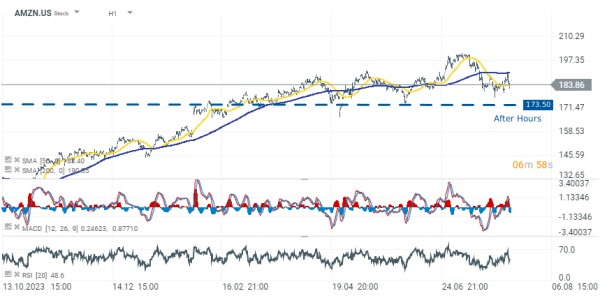

Amazon drops 5.70% after quarterly earnings 📌

Amazon (AMZN.US) drops 5.70% in post-market trading in the USA. The Q2 results were close to consensus, but this was not enough to meet investors' high expectations. As a result, Amazon deepens today's decline to $173.50 per share. Despite this, year-over-year results are significantly better and confirm a growth trend.

- Revenue: USD 148 billion, up 10.2% year-on-year, below estimates by USD 760 million.

- Sales in the North American region: USD 90 billion, up 9% year-on-year.

- AWS segment sales: USD 26.3 billion, up 19% year-on-year.

- Operating profit: US$14.7bn, more than doubled from US$7.7bn in Q2 2023.

- AWS operating profit: $9.3bn, up from $5.4bn in Q2 2023.

- Net profit: $13.5bn ($1.26 per share), up from $6.7bn ($0.65 per share) in Q2 2023.

Guidance for Q3 2024:

- Revenue: US$154bn to US$158.5bn, up 8% to 11% year-on-year.

- Operating profit: $11.5bn to $15bn, up from $11.2bn in Q3 2023.

Amazon Web Services (AWS), a key part of Amazon's operations, showed impressive growth and significant contributions to overall results. AWS sales increased by 19% year-over-year to $26.3 billion, and operating income was $9.3 billion compared to $5.4 billion in the previous year. CEO Andy Jassy highlighted the continued high demand for the AWS segment, driven by increasing demand for cloud services and generative AI models. AWS continues to attract customers with its comprehensive functionality, security, operational efficiency, and advanced AI capabilities such as SageMaker, Bedrock, Trainium, and Q for various AI applications.

For the next quarter, Amazon provided cautious but optimistic guidance. The company expects net sales to be between $154 billion and $158.5 billion, representing an 8% to 11% increase compared to the third quarter of 2023, although it acknowledges a negative currency impact of 90 basis points. Operating income is projected to be between $11.5 billion and $15 billion, compared to $11.2 billion in Q3 2023. Amazon's management emphasized the risk of not meeting future projections due to factors such as changing economic conditions, currency fluctuations, and customer demand, but remains confident in its strategic initiatives and market position.