American Express drops after Q1 results

American Express (AXP.US), US financial services company, reported Q1 2024 results today ahead of the Wall Street session open. Report turned out to be slightly better-than-expected, but the stock moved lower in premarket anyway.

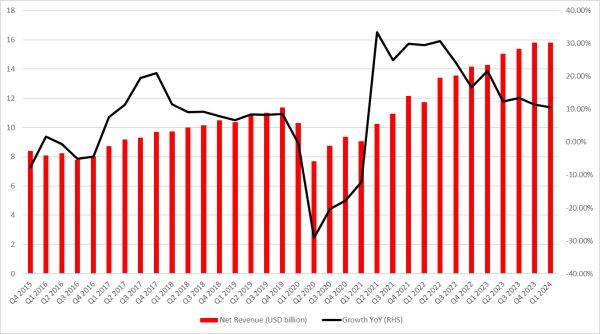

Company's total revenue jumped 10.6% YoY to $15.80 billion. While this was slightly more than expected, it was also a further moderation in growth. Year-over-year revenue growth rate for Q1 2024 was the slowest since Q1 2021. However, growth in total expenses was slower, hinting at an improved efficiency. Company said that a strong jump in profit reflects continued business momentum and that an increase in provisions for loan losses resulted from higher net charge-offs.

However, while results for Q1 2024 beat expectations, this improvement in business was not big enough to trigger an outlook upgrade. Company still expects full-year revenue to grow 9-11% this year, while EPS is still expected to reach $12.65-13.15, which would mark an increase of 12.8-17.3% compared to 2023.

Q1 2024 earnings

- Revenue: $15.80 billion vs $15.77 billion expected (+10.6% YoY)

- Discount revenue: $8.38 billion vs $8.38 billion expected (+5.4% YoY)

- Provisions for credit losses: $1.27 billion vs $1.31 billion expected (+20.3% YoY)

- Total expenses: $11.39 billion vs $11.58 billion expected (+3% YoY)

- Card reward expenses: $3.77 billion vs $3.97 billion expected (+0.2% YoY)

- Network volume: $419.2 billion vs $419.3 billion expected (+5.1% YoY)

- Total card member loans: $126.6 billion (+16% YoY)

- Effective tax rate: 22.5% vs 23.5% expected (16.2% a year ago)

- Net income: $2.44 billion vs $2.19 billion expected (+34.2% YoY)

- EPS: $3.33 vs $2.96 expected ($2.40 a year ago)

Full-year 2024 forecasts

- Revenue growth: unchanged at 9-11%

- EPS: unchanged at $12.65-13.15 vs $12.83 expected

American Express beat expectations, but growth in net revenue continued to moderate in Q1 2024 and was the slowest since Q1 2021. Source: Bloomberg Finance LP, XTB Research

American Express beat expectations, but growth in net revenue continued to moderate in Q1 2024 and was the slowest since Q1 2021. Source: Bloomberg Finance LP, XTB Research

American Express (AXP.US) is trading a touch lower in premarket, following release of Q1 2024 report that beat expectations but did not include outlook upgrade. Stock has recently broken below the 50-session moving average (green) and has been struggling to climb back above it. Source: xStation5

American Express (AXP.US) is trading a touch lower in premarket, following release of Q1 2024 report that beat expectations but did not include outlook upgrade. Stock has recently broken below the 50-session moving average (green) and has been struggling to climb back above it. Source: xStation5