Apple - what to expect from the 3Q23/24 results? 📊

Apple (AAPL.US) will release its 3Q23/24 results today after the close of the US session. The main focus for investors will be data on revenue growth in the Chinese market, as well as possible new information regarding the use of AI.

3Q23/24 forecasts

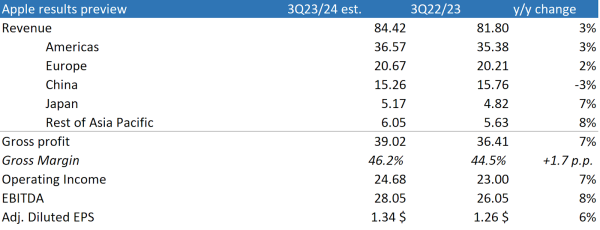

Analysts' consensus forecasts growth in all of the company's key financial figures. Revenues are expected to reach $84.42 billion, which would be 3% higher than a year earlier. This would also mark a record Q3, which seasonally performs worse than the others. At the gross profit level, the consensus forecasts $39.02 billion, which implies a 46.2% gross margin (+1.7 p.p.). Analysts also anticipate an increase in operating margin, thanks to a 7% growth in operating profit. They estimate its value at $24.68 billion. This implies an increase in adjusted diluted earnings per share to $1.34 (+6% y/y).

Apple's projected earnings (in $ billion, excluding earnings per share). Source: Bloomberg, XTB Research

Sales in China a major unknown

Apple has been facing problems in the smartphone market in China since the end of last year. In recent quarters, iPhone sales have regularly declined there, affecting both the company's results and its position in the market. Apple has been losing market share in China mainly to local competitors such as Huawei and Xiaomi.

One of the most important pieces of information from the perspective of investors during this quareter's results will be the future of sales in China. Investors are expecting news that these levels are stabilizing. This scenario might be indicated by data released by the China Academy of Information and Communication Technology (CAICT) on increasing sales of foreign smartphones in the domestic market, which was up 10.9% year-on-year in June, and by almost 40% year-on-year in May. The data includes all foreign brands, but the increase is also likely to be reflected in Apple's performance, as the company is the main foreign player in China's smartphone market.

The increase in sales in China was also related to strong discounts of Apple products in that market. Hence, while sales may grow in volume terms, this may not necessarily translate into an increase in revenue alone. The consensus forecast is for revenue from China to decline 3% y/y in 3Q23/24. Such dynamics would mean a consolidation of the trend of improving declines and in preparation for stabilization in this market, which is what investors are most hoping for.

Apple's sales growth rate in China. Source: Bloomberg, XTB Research

The AI topic still on the table

Investors continue to await new information on the use of AI in new device software from Apple. For now, according to information from the company, in the first version of iOS 18 (set for release in September), solutions based on artificial intelligence will not be present, and its implementation is expected to be introduced in an update in October. New information on the latest generation of iPhones, Macs, iPads and artificial intelligence could be positive catalysts for the company's stock price increases.

A look at the chart

Apple, after a slight correction, bounced yesterday from a support level around $216. This level is at the same time near the local peak of mid-June. The company, despite the correction, remains in an upward trend. After the previous results, the company recorded a jump of more than 8% at the opening. A similar range of movement after today's results would imply an approach to the $240 level, which would mean an ATH breakout.

So far, the results of companies from the so-called "Magnificent Seven" indicate, on the one hand, the continued strength of technology companies. However, on the other hand, reactions to these results show that investors are demanding virtually perfect data from the companies. At current market prices, a positive surprise over analysts' estimates is mostly priced in, hence if Apple does not significantly beat expectations a return to a correction and a discount in after-hours trading is possible.

Source: xStation