As earnings season winds down, what’s next for US stocks? – Stock Markets

Solid Q4 earnings season driven by Magnificent 7

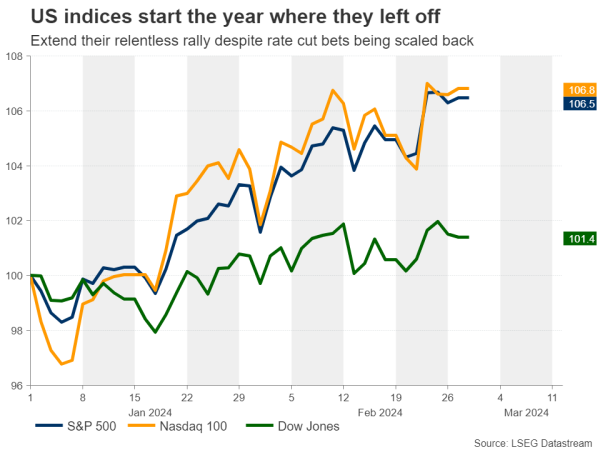

Stocks extend rally despite bets for fewer rate cuts

Excluding an exogenous event, no risks on the horizon

Corporate earnings aid stock market rally

As most US companies have revealed their Q4 financials, it is now safe to draw some conclusions regarding the health of the corporate world. The results have been more than encouraging, with the S&P 500 being on track for a 10.0% annual earnings growth according to LSEG, beating pre-earnings-season estimates by a wide margin. However, on the revenue front, things are not looking that great as a 3.4% year-on-year increase for the S&P 500 translates to a flat-to-negative figure if we account for inflation.

Undoubtedly, the performance of AI-related companies stole the limelight, solidifying once again that AI has significant growth potential. Nevertheless, investors are becoming worried that the market is currently in a distorted state, where just a very small proportion of the index is doing all the heavy lifting, while the vast majority is stagnating.

This overconcentration induces the risk of a significant pullback in case the AI darlings exhibit signs of a slowdown. Besides that, there are some similarities with the dot-com bubble in the sense that most companies with AI features have been already priced in for perfection. For now, stock markets have been riding the wave of AI, storming to consecutive all-time highs.

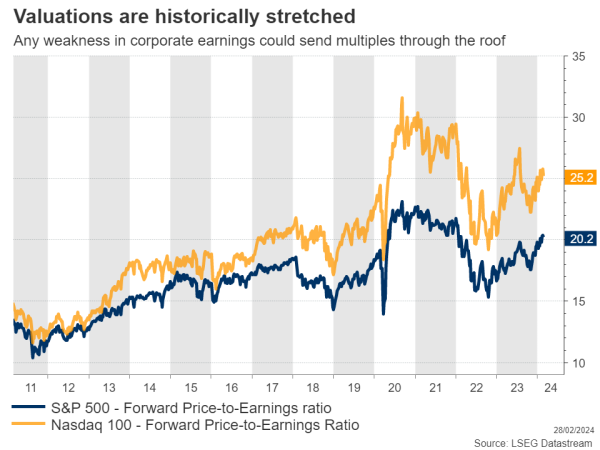

Valuations are inflated

Both the S&P 500 and Nasdaq 100 are currently trading at multiples only seen during the pandemic and the dot-com bubble, which were both followed by a significant stock market rout. For the past few months, stock prices are growing faster than earnings, despite the wave of upbeat financial reports and upward revisions in forward estimates.

More interestingly, the stock market rally has accelerated, even though markets have been scaling back their interest rate cuts projections. The repricing from six rate cuts in the start of the year to three has led to the firms’ future cash flows being discounted with substantially higher interest rates. In contrast to what we were seeing in Q4 of 2023, stock markets currently seem more focused on the fundamental strength rather than the interest rate trajectory.

Considering the series of stronger-than-expected macroeconomic and corporate data in the US, it is difficult to argue that there are significant volatility events ahead of us that could put an end to the relentless stock market advance. Hence, in the absence of an exogenous event, the short-term outlook appears to be neutral-to-positive.

Where could the rally end?

From a technical perspective, the US 500 stock index has been forming consecutive record highs following its break above the crucial 5,000 psychological mark in 2024. As the price has been fluctuating into uncharted waters, the Fibonacci extensions could be a useful tool to forecast potential support zones.

If the index extends its advance to fresh highs, initial resistance could be found at 5,130, which is the 123.6% Fibonacci extension of the 4,817-3,489 downleg.

To the downside, the bears could aim for the 5,000 psychological level ahead of the 2021 high of 4,817.