Aston Martin plunges 25% as sales outlook dims

Aston Martin shares have plummeted over 25% today, marking their biggest one-day drop in four years. Shares have erased some of the declines but despite that hit their lowest point since 2022. The luxury carmaker's stock, already trading at very low levels from the history point of view, has been hit hard by a reduction in its sales forecast.

The company warned that its EBITDA will be lower than the previous year and has abandoned its plans to report positive cash flow in the second half of the year. Third-quarter sales are also expected to miss market expectations.

Aston Martin is the latest automaker to issue a warning about a slowdown in sales. The company recently appointed a new CEO, Adrian Hallmark, who has acknowledged that previous sales targets were overly ambitious. Hallmark indicated that the company will produce around 1000 fewer cars than previously forecast this year and will not achieve its gross margin target of 40% for the year.

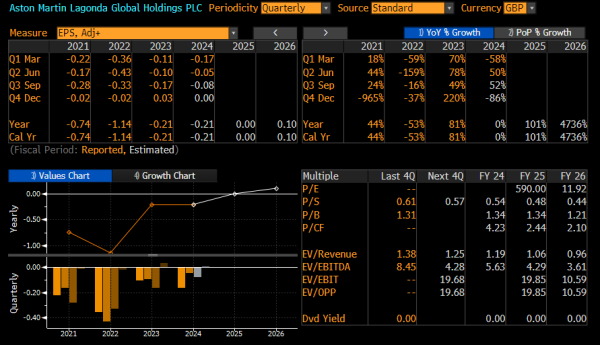

Analysts have not changed their 2025 outlook for Aston Martin, when the company is expected to turn a profit for the first time in several years. However, some analysts have lowered their 2024 EBITDA forecast to around £300 million, compared to the previous consensus of over £360 million.

The company may become profitable next year. Source: Bloomberg FInance LP, XTB

The stock currently has 7 buy ratings, 4 hold ratings, and 1 sell rating, with a consensus price target of 240 pence. Currently, the stock is trading about 100 pence lower than price target.