AUD: Hard to Buy in RBA’s Hawkishness

Key Points:

- The Reserve Bank of Australia held the cash rate at 4.35% with a hawkish tone, emphasizing inflation risks. Lack of any rate cut plans may be seen a policy misstep, especially as markets grow increasingly concerned about a global recession.

- Bias on the AUD has turned bearish given recession concerns could feed into lower commodity prices.

- Additionally, the unwinding of carry trades is another negative factor for the AUD.

- China’s easing measures could provide a temporary boost, but the bar for a Chinese turnaround is high.

The Reserve Bank of Australia (RBA) delivered a hawkish hold at its August 6 meeting. Cash rate was kept unchanged at 4.35%, as expected, but there was an emphasis on upside risks to inflation. While markets have removed the odds of another rate hike from the RBA after the softer Q2 CPI last week, there were no clear signals from the meeting for the markets to start considering rate cuts. This was anticipated after the Q2 CPI release, as discussed here.

However, global risk sentiment has shifted significantly between last week and the RBA’s meeting. There has been a sharp selloff in global equity markets amid increasing concerns about a US recession. This has accelerated calls for the Federal Reserve to deliver rate cuts sooner, potentially even before the September meeting, or to go big with a 50bps cut in September.

Given the shift in the macro backdrop, the RBA lack of guidance on its rate cut plans at the August meeting seems to be a misstep. This could be problematic if global growth deteriorates beyond the soft landing many have hoped for. Much like the Fed, the RBA may be vulnerable to market concerns about being behind the curve. This makes it challenging for the AUD to rally on the back of an overall hawkish meeting outcome.

From here, the risk reward is tilted bearish for AUD, given:

- Recession Concerns: Although markets are regaining some calm after a two-day rout, recession concerns are unlikely to disappear soon. US economic data may not be weakening unilaterally, but the broadening weakness could keep markets volatile until the Fed intervenes, verbally or through action. These recession concerns are likely to negatively affect commodity prices, a key driver for the Australian economy. As commodity prices fall, the AUD faces additional downward pressure.

- Unwinding of Yen Carry Trades: The trifecta of a hawkish Bank of Japan, rate cut hints from the Fed, and escalating geopolitical risks have led to a sharp strengthening of the yen recently. This has spurred concerns of an unwinding in carry trades, which negatively impacts the preferred carry target like AUD. If volatility remains high and global yield gaps narrow, the unwinding of carry trades could extend further.

- Scope for a Dovish Repricing in RBA Curve: Money markets are currently pricing in the RBA to cut rates only in December, by which time the Fed as well as the New Zealand’s central bank are expected to deliver over 100bps of easing. Even if global growth remains resilient and the Fed and RBNZ cut rates less than expected, there is a fair chance that RBA pricing will become relatively dovish. Global growth weakness can quickly impact Australia, prompting the RBA to cut rates more than currently expected.

- China’s PBoC Could Cut Rates but Sharp Turnaround in Chinese Economy is Unlikely: China’s economic policies also play a crucial role in the AUD's performance. The People’s Bank of China (PBoC) has shifted focus from supply-side reforms to demand-side stimulus, potentially leading to further rate cuts to boost consumption. If the PBoC announces more demand-side stimulus, this could be a positive factor for the AUD. However, Chinese authorities also need to keep the yuan relatively weaker to maintain export competitiveness, limiting any sharp strengthening of the yuan despite potential USD weakness. This could keep rate cuts measured. Moreover, the bar for a turnaround in the Chinese economy and, consequently, providing a boost to Australia’s economy remains high.

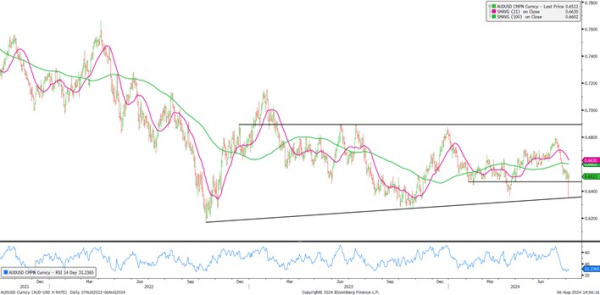

Key Levels to Watch

The AUDUSD pair is currently in a consolidation phase with a bearish bias. Traders should watch for a break of the key support or resistance levels for a clearer direction. Immediate support is seen at May lows of 0.6465 or the trendline support at 0.6380. Resistance at 21-day moving average at 0.6630. The RSI is close to oversold territory, suggesting a potential for a rebound. However, the overall trend remains bearish unless the price can break above the moving averages and sustain those levels. The trendline support near 0.6465 is crucial to watch for potential bounce or breakdown scenarios.

Disclaimer:

Forex, or FX, involves trading one currency such as the US dollar or Euro for another at an agreed exchange rate. While the forex market is the world’s largest market with round-the-clock trading, it is highly speculative, and you should understand the risks involved.

FX are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading FX with this provider. You should consider whether you understand how FX work and whether you can afford to take the high risk of losing your money.

Recent FX articles and podcasts:

- 1 Aug: GBP: Bank of England Cut Won’t Damage Pound’s Resilience

- 31 Jul: JPY: BOJ’s Hawkish Policy Moves Leave Yen at Fed’s Mercy

- 31 Jul: AUD: Softer Inflation to Cool Rate Hike Speculation

- 26 Jul: US PCE Preview: Key to Fed’s Rate Cuts

- 25 Jul: Carry Unwinding in Japanese Yen: The Current Dynamics and Global Implications

- 23 Jul: Bank of Canada Preview: More Cuts on the Horizon

- 16 Jul: JPY: Trump Trade Could Bring More Weakness

- 11 Jul: AUD and GBP: Potential winners of cyclical US dollar weakness

- 3 Jul: Yuan vs. Yen vs. Franc: Shifting Carry Trade Strategies

- 2 Jul: Quarterly Outlook: Risk-on currencies to surge against havens

- 26 Jun: AUD, CAD: Inflation Rising, Can Central Banks Stay on Pause?

- 21 Jun: JPY: Three-Way Pressure Piling Up

- 20 Jun: CNH: China Authorities Loosening their Grip, But Devaluation Unlikely

- 19 Jun: CHF: Temporary Haven Flows Unlikely to Fuel SNB Rate Cut

- 18 Jun: GBP: UK CPI Details and Elections Will Keep BOE on Hold

- 13 Jun: BOJ Preview: Tapering and Rate Hike Talk Not Enough to Boost JPY

- 10 Jun: EUR: Election jitters and ECB rate cut add to downside pressures

Recent Macro articles and podcasts:

- 2 Aug: Singapore REITs: Playing on Potential Fed Rate Cuts

- 30 Jul: Bank of Japan Preview: Exaggerated Expectations, and Potential Impact on Yen, Equities and Bonds

- 29 Jul: Potential Market Reactions to the Upcoming FOMC Meeting

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

Weekly FX Chartbooks:

- 5 Aug: Weekly FX Chartbook: Dramatic Shift in Market Narrative

- 29 Jul: Weekly FX Chartbook: Mega Week Ahead - Fed, BOJ, Bank of England, Australia and Eurozone CPI, Big Tech Earnings

- 22 Jul: Weekly FX Chartbook: Election Volatility and Tech Earnings Take Centre Stage

- 15 Jul: Weekly FX Chartbook: September Rate Cuts and the Rising Trump Trade

- 8 Jul: Weekly FX Chartbook: Focus Shifting Back to Rate Cuts

- 1 Jul: Weekly FX Chartbook: Politics Still the Key Theme in Markets

FX 101 Series:

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar