AUD/USD analysis: Focus turns to GDP data after unexpected CPI rise

Higher-than-expected monthly CPI data watered down expectations for RBA interest rate cuts in 2024; the markets will now shift attention to quarterly GDP data on Wednesday, June 5.

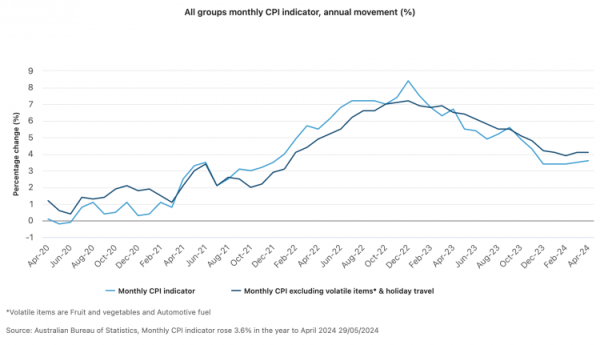

Monthly CPI indicator signals sticky inflation

Australia’s monthly CPI indicator was stronger than expected in April, suggesting sticky inflationary pressures in the economy. The headline CPI figure rose to 3.6% from 3.5%, defying expectations of a drop to 3.4%. More worryingly, the trimmed mean figure, a better measure of underlying inflation, rose to 4.1%, extending a recent trend. While the CPI indicator does not account for the full CPI basket of the official quarterly release, the data implies that the disinflation process in the Australian economy is stalling and that inflation could be re-anchoring above the central bank’s target.

(Source: ABS)

What is your sentiment on AUD/USD?

0.65590 Bullish or Bearish Vote to see Traders sentiment!Market sentiment:

Bullish Bearish

76% 24%

You voted bullish.

You voted bearish.

Give AUD/USD a try

Start trading Start trading Start trading or Try demoTraders price out RBA cuts in 2024

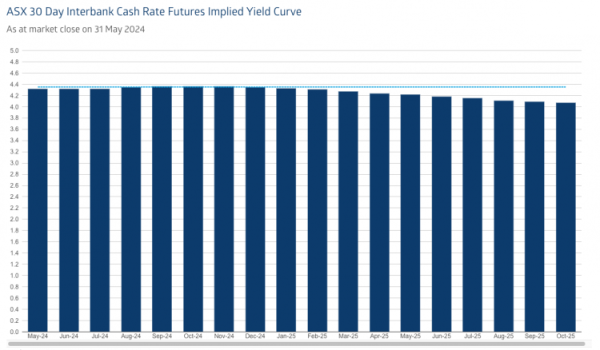

The CPI indicator reaffirmed the view implied in the markets that the RBA will be on hold for the rest of 2024. Despite signs of weaker economic activity and a softening labour market, trimmed mean inflation potentially 150 basis points above the mid-point of the RBA’s target range suggests policy needs to be restrictive for a more extended period to return inflation to target. However, futures suggest the markets don’t see the need for further rate hikes, with the implied next move in the cash rate a cut, priced-in for the first or second quarter of 2025.

(Source: ASX)

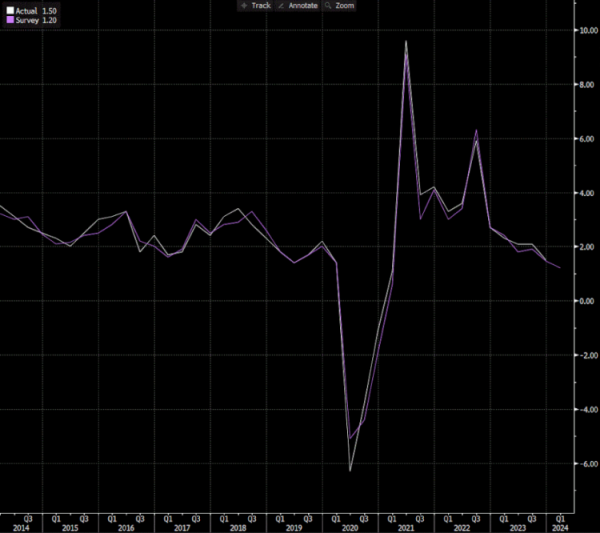

GDP data expected to affirm softening growth trend

Forecasters expect decelerating economic growth in Australia in the fiscal third quarter. Consensus estimates point to a 1.2% year-over-year rise in GDP, falling from 1.5% in the previous period. Mixed GDP partials leading into the national accounts imply potential downside risks to this number. The markets will focus on “per capita GDP growth” for clues about household strength and to what extent high levels of overseas migration are driving economic activity.

(Source: Bloomberg)

Technical analysis: AUD/USD

As always, fluctuations in the US dollar, as the market prices in US interest rate expectations, drive the AUD/USD. Therefore, US employment data will be the most significant fundamental influence on the pair this week. From a technical standpoint, the AUD/USD is forming a continuation pattern, which suggests a looming break-out. A push above downward sloping trendline resistance could be a bullish signal. The market has faded rallies above 67 cents, while dips have been bought below 66 cents.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)