Australian Dollar Forecast: AUD/USD Eyes $0.69 as RBA Decision and China Policy Loom

RBA Interest Rate Decision: Hawkish or Dovish?

The RBA interest rate decision, Rate Statement, and press conference will impact the AUD/USD pair on Tuesday, September 24. Economists expect the RBA to hold the cash rate steady at 4.35%.

Recent flash PMI numbers for September likely reduced expectations of a Q4 2024 RBA rate hike. The crucial Judo Bank Services PMI fell from 52.5 in August to 50.6 in September. Nevertheless, inflation remains above the RBA’s target range of 2-3%. Elevated inflation may expose the AUD/USD to a potentially hawkish RBA.

RBA Governor Michele Bullock’s stance could surprise the markets. Support for holding the cash rate through Q4 2024 could push the AUD/USD toward $0.69. Conversely, hints of a Q4 2024 RBA rate cut could pull the AUD/USD down toward $0.67500.

RBA Governor Michele Bullock’s Stance on Monetary Policy

In early September, Governor Bullock said that interest rate cuts were unlikely in 2024, citing elevated housing costs and market services inflation. The message was less hawkish than an August warning about raising rates to address high inflation.

Australian Inflation Trends and Forecasts

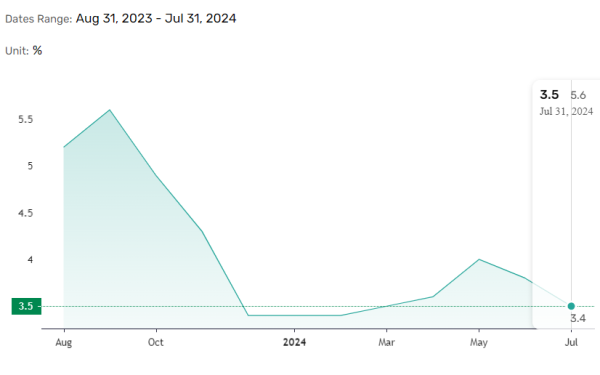

Inflation has softened, with the Monthly CPI Indicator falling from 3.8% in June to 3.5% in July. Notably, the August Monthly CPI Indicator is due on Wednesday, with economists expecting inflation to fall to 3.1%.

China’s Top Financial Regulators to Attend a Pre-Market Press Conference

Meanwhile, China’s top financial regulators will attend a pre-market press conference on Tuesday, News of the press conference fueled speculation about policy measures to boost the Chinese economy. Policy measures to bolster the Chinese economy could positively impact the Aussie economy and dollar. China accounts for one-third of Aussie exports.

A hawkish RBA press conference and possible policy measures from China could push the AUD/USD through $0.69.

US Economic Calendar: Consumer Confidence in Focus

Later in the session on Tuesday, economists expect the CB Consumer Confidence Index will fall from 103.3 in August to 102.9 in September. A modest decline could support expectations of a soft US landing. Consumer confidence is a leading indicator of private consumption, which accounts for over 60% of the US economy.

Weaker-than-expected numbers could push the AUD/USD toward $0.69. However, a drop below 100 may reignite fears of a hard US landing. A flight to safety may impact demand for the AUD/USD.

Short-Term Forecast for AUD/USD

Near-term AUD/USD trends will hinge on policy news from China and the RBA press conference. Policy measures from Beijing to support the Chinese economy and hawkish RBA signals could push the AUD/USD toward $0.69.

Investors should closely monitor central bank signals and economic indicators, which will likely influence AUD/USD trends. Monitor the real-time data, news updates, and expert commentary to adjust your trading strategies.

AUD/USD Technical Analysis

Daily Chart

The AUD/USD hovers comfortably above the 50-day and 200-day EMAs, affirming the bullish price signals.

A return to the September 23 high of $0.68536 could support a move toward the $0.69 level. Furthermore, a break above $0.69 would bring the $0.70 level into play.

Traders should consider the RBA interest rate decision and press conference, news updates from China, and US economic indicators.

Conversely, a drop below the $0.68006 support level could signal a fall toward $0.67500. However, a fall through $0.67500 may give the bears a run at the $0.67050 support level.

With a 14-period Daily RSI reading of 63.74, the Aussie dollar could return to the $0.69 level before entering overbought territory.