Becoming a Pro Trader: Master the Forex Market – Part 5

Times to trade Forex

When you trade is very important in the forex market

There are good and bad times to trade the foreign exchange markets and this article is designed to give you an introduction to the best and the worst times to trade them. The FX markets are open 24 hours a day for 5 days a week and they close over the weekend. So, unlike the stock markets, which have opening and closing times during the week, the foreign exchange markets can be traded at any time, day or night, during the week. However, just because they could be traded it does not mean they should be traded. This is especially true if you are looking at trading shorter, intraday moves.

The three different foreign exchange market sessions

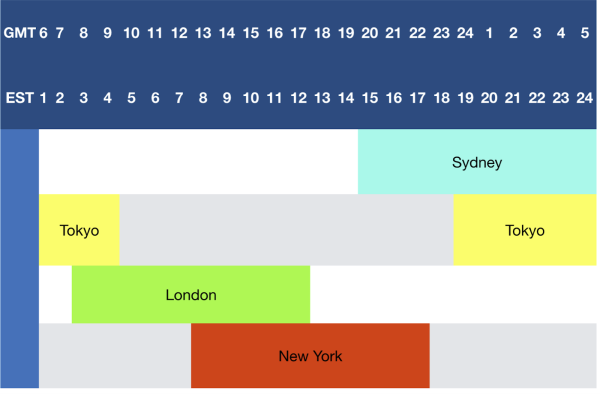

Each foreign exchange trading day can be divided into three different sessions: the Asian, London and New York session. The session times can be seen in the chart below with GMT and EST times marked. In the chart below, the Tokyo and Australian sessions occur during the overnight and Asian session. This session has smaller volumes of trading activity and ranges are far narrower than in the other two trading sessions. As a result, you would use smaller stops and targets as the overall movement of the market is likely to be reduced. The end of the Asian session runs into the London session and the FX markets start to move into greater ranges. As the London session traders head out for their lunch, traders for the New York session arrive at their desks. Now, for a period of about 4 hours, the London and New York session’s overlap. The second part of the New York session is quieter that the first part, as the London traders have gone home. The close of the trading day happens at the end of the US session and the next day it starts all over again with the start of the Asian session around 0000 GMT.

October/November – March April

So, when are the good times to trade?

The overlap between the London and New York session

The best session to trade is the London session since it overlaps with the US session. In the chart above we can see that the London session opens at 0800 GMT (London time). That session runs for about four hours until the US session opens at 1300 GMT. From here there are four hours in the afternoon where both the London and the New York trading sessions are both taking place. Therefore, the majority of all foreign exchange transactions take place during the hours of 0880 – 1700 GMT. It is the busiest of the foreign exchange day.

Ok, when are the bad times to trade?

The foreign exchange new week’s open

There are two main reasons that this can be a bad time to trade the market. Firstly, this can be a bad time to trade because the spread (the difference between the bid and ask price) can widen considerably when the market opens. Essentially, the spread is your cost of doing business. As there are fewer market participants at the start of the trading week the spread is greater. If you were trading a more exotic pair, then you could be looking at paying a very high spread for the trade. This could easily result in you being stopped out unnecessarily as you hadn’t factored in such a large spread. Secondly, as there is less liquidity in the market (liquidity refers to the presence of orders), the price can move very quickly in either direction for little or even no apparent reason. These moves can simply be due to the illiquidity (lack of orders) in the market at the start of the week. So, for these two reasons alone you should generally avoid trading at the start of the week. If you do fin a good reason to trade on a Sunday night, then keep these two facts in mind, and ensure you leave a wide enough stop to factor in the wider spreads and potential price moves of an illiquid market.

Intraday trades heading into the end of the London session

There are a couple of reasons here that this can be a difficult time to trade on an intraday basis. Firstly, as the London session comes to an end, traders are taking their earnings, and this can result in some intraday trends reversing. Secondly, at 1600 GMT each day there is the London fix which is simply orders being executed for businesses and companies who are having their day-to-day currency dealings executed. These are not foreign exchange dealings for speculators but for regular market participants. However, the London fix can result in price moves running counter to the market sentiment.

Major economic releases occur at the opening of the London and New York sessions

Another factor to be aware of is that significant data releases frequently occur at the start of the London and New York sessions. You need to ensure you check the calendar before accidentally opening a trade into a major news release. The large volatility that comes out of these releases is not something to wander into unawares.

<< Previous: Part 4 – Technical Analysis

>> Next: Part 6 – Trading Guide