Becoming a Pro Trader: Master the Forex Market – Part 9

A checklist to help you trade better

Looking in all the right places

Trading mistakes happen all the time. Fat fingers, mistaken purchases and silly entries occur all the time. Adam did a great piece on how to learn to avoid mistakes in executing trades. This article is based on that theme of developing a checklist and is designed to help beginner trades develop a checklist before they enter a trade. So, here are five things every trader should be looking at with their trading:

Look back Look forward Look at the charts Look at your risk Look at the outcome

Look back

When you come to your desk the very first thing to do is to look back across the last couple of sessions to remind yourself of the key events taking place. The simplest way to do that is to read a couple of session wraps and see what the key market events have been. Having read a couple of wraps see if you can put the most important events into a sentence or two. This will give the ‘sentiment’ from the last session and will also be the starting sentiment of the upcoming session. This will be the part where you start to develop a bias for the currencies you want to trade. For example, at the time of writing this article I wanted to short the EUR/GBP pair. The reason was that the euro was under pressure because of the ongoing Italian budget saga and the GBP was being bid on optimism about the financial services sector on completion of a successful Brexit arrangement.

Look forward

Now look forward for any significant events coming up. What you want to do here is to see if there is an anticipated market event coming up. If there is then you must be aware of it as price will often be contained within a tight range before widely anticipated data releases. As the session plays out you will also be looking for opportunities that present themselves either from data releases or from news squawked out during the session.

Look at the charts

By now you have your currency pair to trade and you want to look for key places to enter. This is where you apply your technical analysis. How will you enter the trade? Will you wait for a pullback to a moving average? Perhaps you will use a pivot point as a good place to enter. Your exact method is not the issue here. The issue is that you now decide how you are going to enter the trade.

Look at your risk

As you take your trade you want to ensure that your risk level is not making it hard for you to trade. Ideally you should not be using any leverage in your trading. So, if you have a 10000 GBP account then you should be trading with an 0.10 lot position. That is what it means to trade ‘unleveraged’. Your lot size matches your account size. By simply ensuring that your risk level is dialled down you increase your chances of success.

Look at the outcome of your trade

As you take your trade you want to ensure that your risk level is not making it hard for you to trade. Ideally you should not be using any leverage in your trading. So, if you have a 10000 GBP account then you should be trading with an 0.10 lot position. That is what it means to trade ‘unleveraged’. Your lot size matches your account size. By simply ensuring that your risk level is dialled down you increase your chances of success.

Look at your trading with this checklist

If you don’t yet have a checklist, use this as you approach the markets each day. It will help you avoid silly mistakes like missing key sentiment, entering before key data releases, entering the market randomly and risking too much while failing to learn from your mistakes. All these mistakes are common, yet avoidable (or at least they can be reduced). So, if you are without a method in the markets, start using this checklist today. It may be the beginning of a more strategic way of thinking.

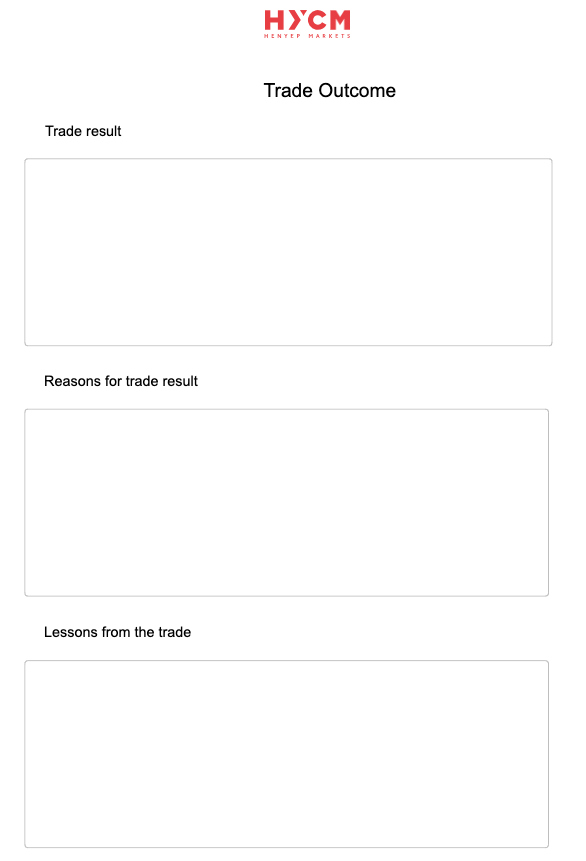

Trade Outcome: Checklist

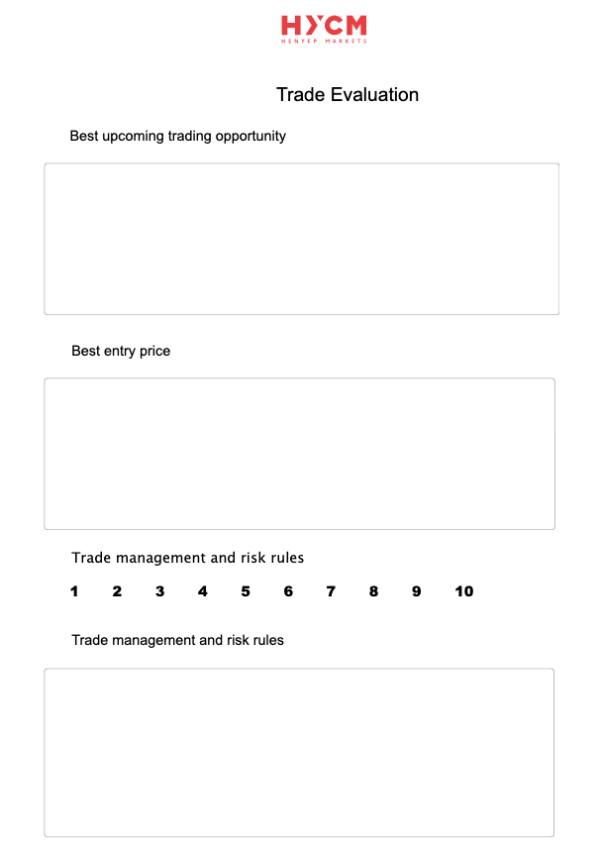

Trade Evaluation Checklist