Besides commodities, volatility is heightened across the board - Volatility Watch

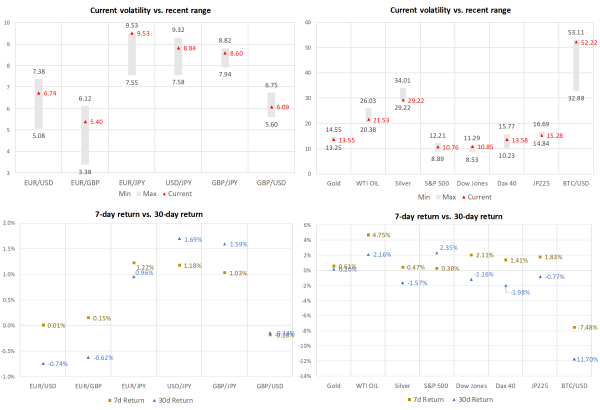

Yen crosses are very volatile as they approach intervention levels

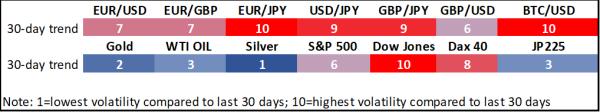

Volatility is extremely low in the commodity sphere

US and global equities exhibit volatility jump, Bitcoin follows suit

Volatility in yen pairs has been elevated for the past few days as they have been trading within breathing distance from the levels that Japanese authorities were willing to defend in the recent past. Meanwhile, despite some signs of stabilization on the continent, the euro remains at the upper end of its volatility range against major currencies.

In commodities, gold and silver have been exhibiting low volatility amid a quiet period on the geopolitical front. Meanwhile, oil volatility seems surprisingly low given that the energy commodity has been in a steady advance since early June.

Turning to risky assets, volatility in US stocks has increased, suggesting that investors could be slowly positioning for a pullback. In Europe, volatility in stock indices has picked up on the back of the renewed political risks that could have implications for European debt markets.

Finally, Bitcoin volatility has skyrocketed following the price’s dive below the $60,000 psychological mark for the first time since May 3.