Bitcoin captures $60,000 amid strong ETF demand – Crypto News

Bitcoin soars 20% in the week and eyes record highs

Ethereum follows suit, leaping to a fresh 22-month peak

Dencun upgrade, halving and rate cuts next on the agenda

Bitcoin posts biggest monthly gain in 3 years

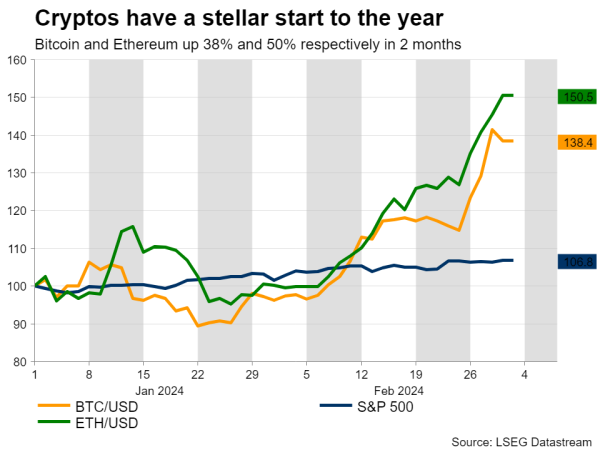

The king of cryptocurrencies has been enjoying a massive rally since Monday, surging from $54,300 to as high as $63,933 on Wednesday before paring some gains. This latest spike concluded a stellar monthly performance for Bitcoin, with its price rising around 43%, marking February as the strongest month since December 2020.

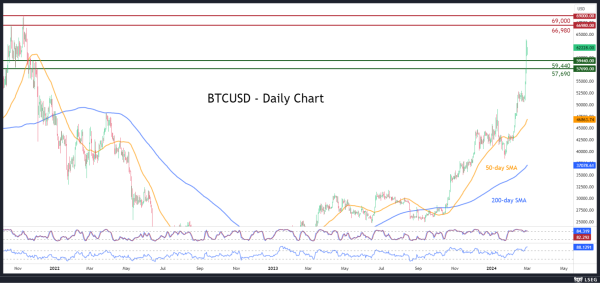

Again, intensifying investor demand towards spot-Bitcoin ETFs was the main catalyst for the uptick in Bitcoin prices, albeit there were no fresh developments in the sector that could justify such a strong move. A potential reason that could provide grounds for the magnitude of the latest round of gains could be the absence of profound resistance levels from a technical perspective.

By conquering the $60,000 mark, the Bitcoin bulls are locking their gaze on the all-time high of $69,000, with the upcoming halving event and Fed rate cuts appearing to be working in their favour. However, the odds for a pullback are also increasing as the current levels provide the perfect opportunity for some profit taking.

Ethereum outperforms in 2024, more upside on the cards

Ethereum has been outperforming Bitcoin in 2024, posting a whopping 50% year-to-date advance. The leading altcoin has been trading profoundly above the crucial $3,000 psychological level during this week, but has encountered strong resistance around $3,500, a territory that coincides with its April 2022 peaks.

There is a wide range of reasons why Ethereum might continue to outperform in the upcoming months. First of all, it is trading in a longer distance from its all-time highs compared to Bitcoin, while it is yet to climb above its 2022 levels. Moreover, Ethereum prices have historically reacted well to any successful update in the altcoin’s network, opening the door for more upside after the impending Dencun upgrade on March 13.

Finally, there is increasing speculation that spot-Ethereum ETFs will also get regulatory approval in the upcoming months. If Bitcoin’s experience serves as an example, institutional demand could provide a significant boost to Ethereum prices.

Levels to watch

BTCUSD has exploded higher since the beginning of the week, claiming the crucial $60,000 psychological mark and eyeing its all-time highs. However, traders should not rule out a pullback as the short-term oscillators are flagging overbought signals.

To the upside, Bitcoin could challenge the October 2021 peak of $66,980 ahead of its all-time high of $69,000.

Alternatively, should the price undergo a pullback, the bears could attack the October 2021 support zones of $59,440 and $57,690.