Bitcoin clocks 2-year high, surpassing $1 trillion in market cap – Crypto News

Bitcoin surges above $52,000 to a fresh 2-year peak

Regains $1T market cap as crypto market touches $2T

Market focus turns on halving event and Fed rate cuts

Bitcoin fires on all cylinders

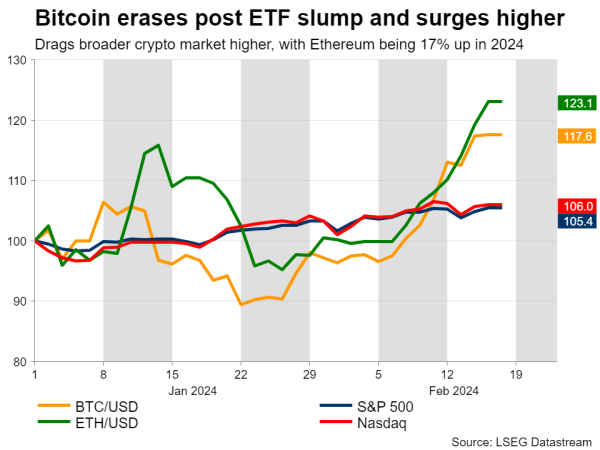

Bitcoin and most major digital coins advanced sharply this week, extending their solid performance in 2024. Despite a minor retreat after the hotter-than-expected US CPI report pushed back against premature rate cut bets, Bitcoin and Ethereum leaped to their highest levels since December 2021 and May 2022, respectively. Moreover, Bitcoin’s market capitalization surpassed the 1$ trillion mark for the first time since late 2021, pushing the broader market’s capitalization around 2$ trillion.

Undoubtedly, the main catalyst behind the latest rally has been the growing interest around spot Bitcoin ETFs. So far, the entrance of big Wall Street players in the crypto space seems to have convinced a significant number of investors that scandals and frauds belong only in the past. This notion has allowed more and more institutional investors to allocate funds in crypto ETFs as the rapidly increasing demand cannot solely stem from retail traders.

In a sense, spot Bitcoin ETFs have achieved their mission of attracting fresh capital inflows in the sector, which are expected to keep growing in the absence of any systemic event. The successful launch opens the door for the approval of altcoin spot ETFs, allowing investors to diversify their crypto holdings.

What’s next?

Things could become even more interesting for cryptocurrencies in the upcoming months as investors are bracing for a raft of key macro and idiosyncratic developments. Firstly, markets are laser-focused on the upcoming halving event, which will take place in April. With Bitcoin mining rewards cut in half, there will be substantial changes in the supply dynamics as many Bitcoin miners might run out of business due to no longer being profitable.

Coincidently, the Fed’s rate cutting cycle could begin a few days after halving as markets are pricing in a 35% probability of such a move at the Bank’s May meeting. If this scenario materialises, we might observe a period of heightened volatility for Bitcoin.

Fresh highs in sight?

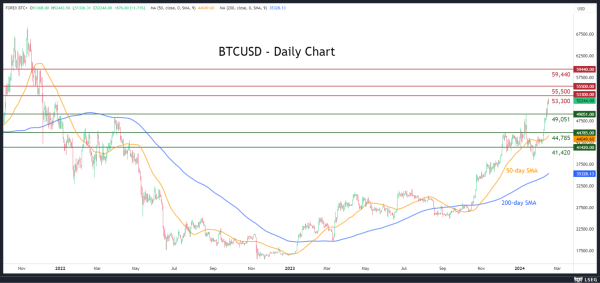

BTCUSD has exploded following its break above the 50-day simple moving average (SMA) on February 7. This week, the price violated the crucial $50,000 psychological mark and surged to a fresh two-year high of $52,852 before paring some gains.

If the rally resumes, Bitcoin could test the November 2021 support zones of $53,300 and $55,500.

On the flipside, in case of a pullback, the previous peaks of $49,051 and $44,785 could provide support.