Bitcoin clocks first negative monthly performance since August – Crypto News

Bitcoin interrupts a four-month winning streak

Despite feeling Fed blues, it follows stocks higher

As ETF buzz subsides, macro factors take front seat

Last week, Bitcoin fell to its lowest level since the US Securities and Exchange Commission (SEC) approved spot-Bitcoin ETFs, validating the anticipated sell-the-news type of reaction. However, since bottoming out, Bitcoin has not looked back again, with the price recovering to around $43,200 at the time of writing on Friday.

The rebound though was not enough to generate a green candlestick in Bitcoin’s monthly chart, while the king of cryptos is also marginally in the red year-to-date. A positive monthly performance would have extended the gaining streak to five, something last seen during the 2020-2021 bull market.

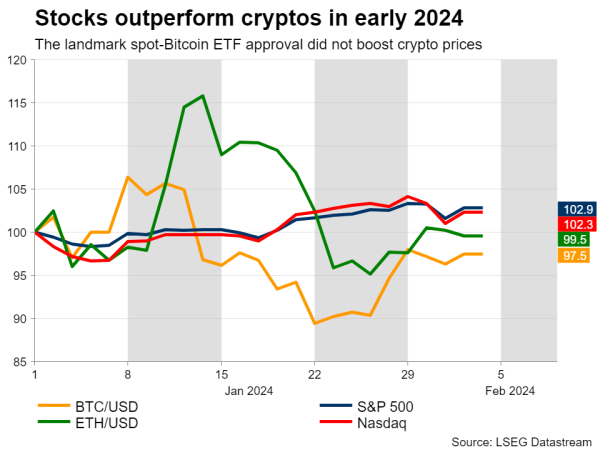

As the ETF dust settles, investors are actively seeking for fresh catalysts that could decide Bitcoin’s trajectory, and for now macroeconomic factors seem to have taken that place. The overall positive sentiment in markets, which has been evident by the relentless rally in US stock indices, helped Bitcoin to halt its post-ETF slump and recoup some losses.

This week, we have seen Bitcoin reacting positively on the back of some strong tech earnings, while also losing some ground after the hawkish FOMC meeting. Therefore, in the anticipation of important idiosyncratic events such as the Bitcoin halving in April, cryptos could be severely influenced by changes in the macroeconomic backdrop.

Is Wall Street adoption good or bad?Since November 2021, a series of frauds and scandals has erupted in the cryptocurrency sphere, undermining investor sentiment and driving away retail flows. In the latest episodes, the UK police seized more than $1.8 billion worth of Bitcoin from a Chinese investment fraud, which included the conversion of stolen money into cryptos. Moreover, the German police confiscated nearly 50,000 Bitcoin worth about $2.1 billion from two suspects that allegedly bought Bitcoin with illegal funds gained from a file-sharing platform.

Therefore, these latest incidents raise the question of whether crypto embracement by Wall Street players is beneficial or not. On the one hand, crypto enthusiasts seem betrayed by this action as digital assets essentially gave away their decentralised attributes. Nevertheless, stricter regulations and big names backing the sector could lead to a rise in institutional inflows, which are currently sitting on the sidelines due to the cascading scandals.

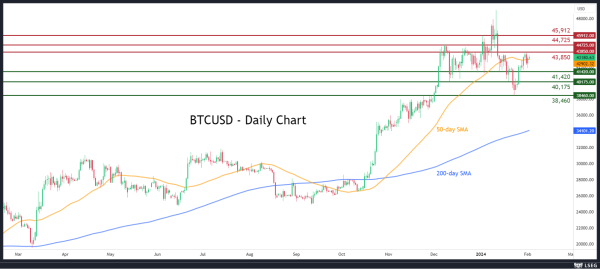

Bitcoin in a fierce battle with 50-day SMABTCUSD experienced a 20% decline from its two-year high of $49,051, falling to as low as $38,460. However, the price quickly bounced back above the $40,000 psychological mark, while the bulls have been trying to conquer the 50-day simple moving average (SMA) in the past few sessions.

To the upside, Bitcoin could surge towards the recent rejection region of $43,850. Claiming this barricade, buyers might attack the December high of $44,725.

Alternatively, should the price reverse lower, the inside swing low of $41,420 could act as the first line of defence. In case of a downside violation, the price may face the December support of $40,175.