Bitcoin gains to $63,000, driven by Fed rate cuts cycle optimism and weaker US dollar🗽

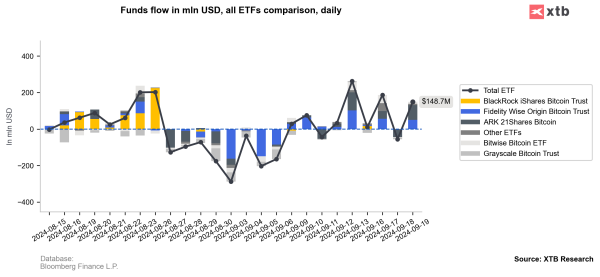

Lower expected Fed interest rate levels, almost in line with 'dovish' market expectations, Wall Street strength and dollar weakness, supported Bitcoin and cryptocurrency market sentiment. The day after the Fed rate cut, net inflows into ETFs totaled nearly $150 million - not so much, looking at the markets' reactions.

Interestingly, inflows to BlackRock (IBIT) have been almost non-existent since the last week of August; inflows to ARK 21 Shares and Fidelity come after a lot of BTC evaporated from these funds in August-September. Today, Bitcoin is traded near $63,000; it's level above major important zones such as Short-Term Holders Realized Price and average US spot ETFs Bitcoin buying price.

Source: Bloomberg Finance L.P. , XTB Research

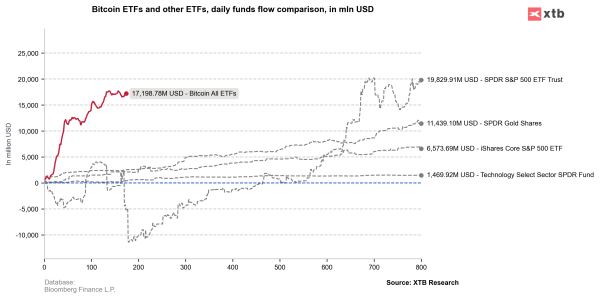

This year, inflows into BTC ETFs total nearly $17.2 billion in net inflows, compared to $20 billion for the 'flagship' S&P 500 ETF. This is still a great result.

Source: Bloomberg Finance L.P. , XTB Research

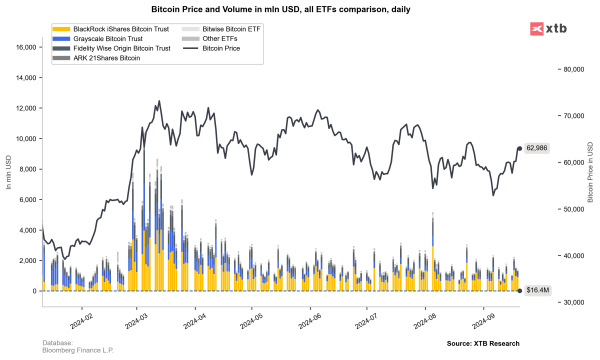

BTC's trading volume cooled noticeably in the second half of the year; historically, however, autumn has typically been very successful for Bitcoin - counting from October.

Source: Bloomberg Finance L.P , XTB Research

Bitcoin (D1 interval)

The price of BTC has risen above three key momentum averages, with RSI and MACD suggesting a possible continuation of the uptrend. A significant test of the strength of this move may come at the $65k level, where we see the 23.6 Fibonacci abolition of the upward wave from January and the short-term trend line.

Source: xStation5