Bitcoin posts fresh 2-year high in ETF debut week – Crypto News

Bitcoin jumps to its highest since late 2021 after SEC’s ETF approval

US-listed spot Bitcoin ETFs record $4.6 billion volume on launch day

Ethereum climbs to 20-month peak on speculation of impending ETFs

Landmark event but too early to draw conclusions

This week was characterized by the long-awaited decision from the U.S. Securities and Exchange Commission’s (SEC) to greenlight 11 spot-Bitcoin ETF applications from big Wall Street players. Although the positive outcome had been largely priced in, we saw a surge in investor interest. Specifically, Bitcoin posted a fresh two-year high of $49,051 and US-listed ETFs reached $4.6 billion in trading volume on the first trading day following the approval.

However, the spike in Bitcoin’s price was followed by a pullback towards $46,000 on Friday as many short-term traders snatched the opportunity for some profit taking. Undoubtedly, such a milestone moment in the industry would most likely be followed by some volatile sessions, but at least we have not yet seen a sell-the-news type of reaction.

Moving forward, attention will fall on whether spot-Bitcoin ETFs manage to bring the anticipated capital inflows into the sector as a stricter and more transparent framework might attract institutional investors currently sitting on the sidelines. Meanwhile, it might be difficult for financial advisors to start recommending investments in crypto ETFs without any track record or clues on how they fare during different economic conditions.

Don’t forget that despite the regulatory clearance, SEC Chair Gary Gensler stated that the approvals do not equate to an endorsement of Bitcoin, suggesting that it is still a speculative and volatile asset.

Ethereum benefits from recent developments

After a period of underperformance, Ethereum experienced solid gains in the aftermath of the SEC’s decision on spot Bitcoin ETFs. Firstly, the positive outcome triggered speculation of an upcoming spot-Ether ETF, sending the price to a fresh 20-month peak of $2,689. Moreover, it seems that investors are rotating towards the largest altcoin in market cap as with the SEC’s official approval on spot-Bitcoin ETFs, the rally in Bitcoin has probably run its course.

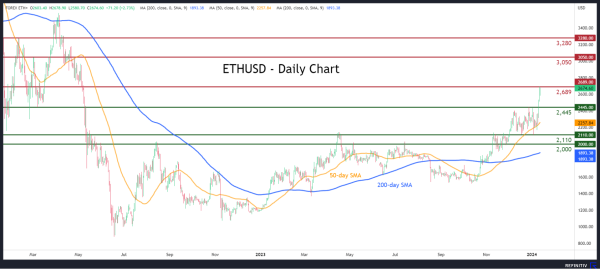

Taking a technical look, ETHUSD is trading very close to its recent 20-month peak, where a violation of that zone could pave the way for the March 2022 hurdle of 3,050. Alternatively, bearish actions could send the price to test the previous resistance zone of $2,445, which also acted as support in March 2022.

Bitcoin levels to watch

BTCUSD has experienced a massive surge since the second half of 2023, posting a fresh two-year peak of $49,051 on Thursday. However, the king of cryptos surrendered some of its gains as the advance reached overbought conditions.

Should the pullback persist, Bitcoin might slide towards $44,785, a region that has provided both resistance and support in recent months. Meanwhile, further upside attempts could bring the recent two-year high of 49,051 under examination.