Bitcoin Price Eyes $75k: Bloomberg Predicts “Elections Frenzy” as Blackrock ETF Inflows Hit 5-Month Peak of $870M

Bitcoin Price Analysis:

Bitcoin price found support at $71,800 level on Wednesday Oct 30, having retraced 2.3% from the monthly peak of $73,565 24-hours earlier. On-chain data trends shows that US based Bitcoin ETF have dramatically increased demand for BTC over the last two weeks leading up to the 2024 Presidential Elections.

Could the rising spot Bitcoin ETF demand propel BTC to new all time highs above $75,000 ahead of the Nov 5 polls.

US-Based Bitcoin ETF Demand Hits 5-Month Peak

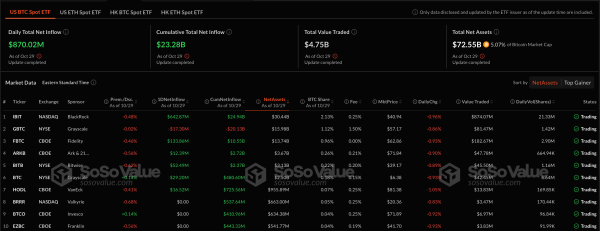

Demand for U.S.-based Bitcoin ETFs soared to a five-month high on Tuesday, Oct 29, led by significant inflows into BlackRock’s IBIT fund.

The IBIT ETF saw $642 million in net inflows, the largest daily inflow for the fund in over seven months. Across all 12 spot Bitcoin ETFs in the U.S., daily net inflows reached $870 million, the highest since early June.

Spot Bitcoin ETFs in the U.S. also recorded a sharp increase in trading volume, rising from $3 billion on Monday to $4.75 billion on Tuesday. BlackRock’s IBIT contributed $3.36 billion to this total, marking its highest trading volume since March 14.

Fidelity’s FBTC recorded $133.86 million in net inflows, followed by Bitwise’s BITB with $52.49 million, VanEck’s HODL with $16.52 million, and Ark and 21Shares’ ARKB with $12.39 million. Five other ETFs reported no net inflows.

Commenting on the volume spike, Bloomberg ETF senior analyst Eric Balchunas noted in an X post that it was “a bit odd,” as Bitcoin had gained 4% on the day.

“Occasionally, though, volume can spike if there is a FOMO-ing frenzy,” said Balchunas. “Given the surge in price [over] past few days, my guess is this is the latter, which means look for (more) big inflows this week. We’ll see though!”

– Bloomberg ETF senior analyst Eric Balchunas.

Balchunas explained that ETF volume typically surges during downturns or crises but suggested this spike might indicate a “FOMO-ing frenzy” driven by recent price gains. He added that the trend could continue, potentially leading to more big inflows this week, as the US 2024 elections inch closer.

Bitcoin New-user Count Surged 25% in the Past Week

While the rising ETF inflows enunciates increased demand from whale investors and corporate entities, on-chain data trends shows Bitcoin is also gaining more popularity among retail traders.

IntoTheBlock’s New Addresses chart below, monitors the number of wallets conducting their very first transaction on each day. This on-chain metric serves as a proxy from tracking the rate at which new users are adopting the underlying cryptocurrency.

351,450 BTC addresses conducted their first transactions on Oct 29, as prices raced to new monthly peaks above $73,565.

Asides from a 25.13% increase in new-user count in the last 7-days, the chart also shows that the last time the Bitcoin blockchain attracted daily new addresses exceeding 350,000 was back in April 2024.

Bitcoin has now pulled off that feat three times in the last two weeks, at Oct 17, 25th and 29th respectively. Essentially, this reflects that the rising demand for BTC observed among whale investors is also resonating among new entrants on the retail level.

Bitcoin Price Forecast: Despite 2% Pull-back, $75,000 Remains Within Reach

Bitcoin price found support at $71,800 down 2.3% on Oct 30, from the 24-hour peak of $73,565.

Based on the current on-chain dynamics, there is strong demand for BTC within the retail and whale market, suggesting potential for more upside. A Bitcoin price breakout above $75,000 could be in play, especially if US ETFs demand surge persists as Bloomberg analyst, Eric Balchunas hinted after Tuesday’s record-breaking $870 million inflows.

Technical Analysis and Key Levels

The 4-hour BTCUSD chart reveals a mixed technical outlook. The Parabolic SAR indicator, marked by blue dots, suggests that BTC might face short-term downside pressure, with the indicator’s positioning above the price action signaling possible bearish momentum.

However, pivot points offer crucial levels to watch. Immediate support rests at $69,874 (R1), a level that could help BTC maintain its bullish stance, especially if new buyers troop in for a last minute pre-election market frenzy.

For an optimistic scenario, if bulls manage to keep BTC above this support, attention will turn to the next resistance levels at $73,448 and $74,146.

Successfully breaching these could position BTC for a retest of the $75,000 psychological mark, though bulls must sustain momentum to capitalize on any upward push.