Bitcoin rally takes a breather, solid year-end in sight – Crypto News

Bitcoin experiences a correction following a fresh 20-month peak

Probably due to some profit-taking as macro developments aid

Cryptos set for a stellar year of outperformance against major assets

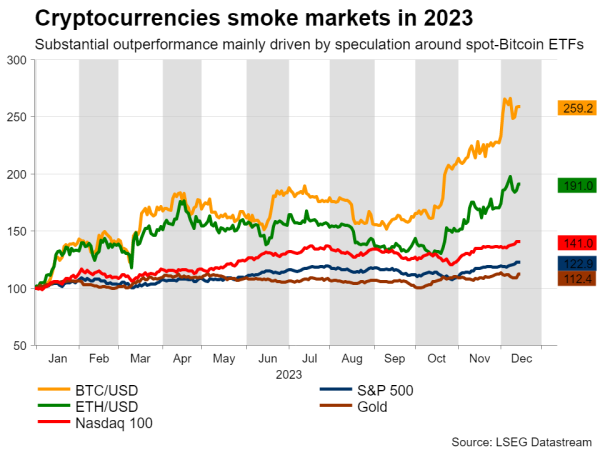

Undoubtedly, Bitcoin and cryptocurrencies in general have exhibited impressive performance so far in the year, following a catastrophic 2022. The king of cryptos has gained more than 155% year-to-date, while it has appreciated more than 50% within the past two months. But it is not just Bitcoin, major altcoins have been performing relatively well, with Ethereum being 90% up in 2023.

The main catalyst behind this relative outperformance is the impending approval of spot-Bitcoin ETFs by the Securities and Exchange Commission (SEC), which is believed to spark a wave of institutional demand. Lately, we are seeing a series of positive steps towards crypto adoption as markets are getting the sense that the sector is eventually headed to a stricter regulatory framework.

For instance, Google updated its crypto-related advertising policy to permit advertisements from US based crypto firms from January onwards, five years after the tech giant banned this type of ads. Moreover, the Financial Accounting Standards Board (FASB) imposed new rules effective from December 15, which demand from companies to report cryptocurrency holdings at fair value in their financial statements, aiming to improve transparency and credibility.

Santa rally?Zooming into the short-term picture, Bitcoin experienced its worst intraday performance in four months on Monday, probably due to some profit taking. Few days before that though, the leading cryptocurrency had posted a fresh 20-month peak of 44,785, extending its structure of higher highs. Meanwhile, the bulls managed to erase a part of Monday's turbulent stretch as risky assets got a boost from the dovish FOMC meeting on Wednesday.

In general, besides the ETF mania, cryptos are benefiting from developments in the macroeconomic backdrop. In the past couple of months, the discussion around monetary policy has quickly shifted from rate hikes to rate cuts, with inflation showing concrete signs of easing globally and growth weakening.

Given that the last day of the year is in two weeks and there are no major volatility events in front of us, it could be argued that cryptos could gain in lockstep with broader risky assets on the back of the festive mood and a bullish macro setup. Moving forward, as the approval of a spot ETF is already priced in, crypto investors should be laser focused on macroeconomic data that could affect or even alter the interest rate trajectory.

Levels to watchBTCUSD has experienced a massive surge in the short term, generating a series of consecutive multi-month highs. Although the price experienced a pullback following its fresh 20-month peak of $44,785, the bulls have managed to recoup some of these losses.

If the recovery resumes and the price storms to new highs, immediate resistance could be met at the February 2022 resistance of $45,855. Failing to halt there, Bitcoin may face the March 2022 peak of $48,226.

On the flipside, bearish actions could send the price lower to test the recent support of $40,175. Further declines might then cease at the November support of $35,000.