BREAKING: ECB cuts deposit rate as expected 🏛️

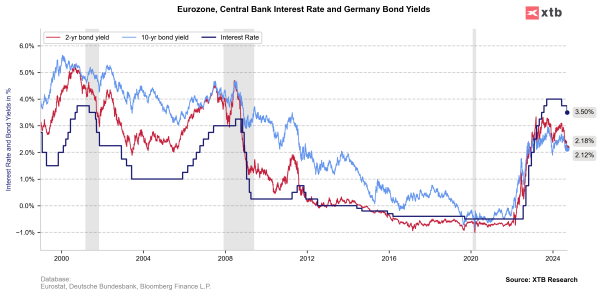

As expected, the European Central Bank decided to cut the key deposit rate by 25 basis points to 3.5%. Shortly after the publication, the euro gained in value against the US dollar. Investors will now focus on the press conference scheduled for 1:45 p.m. BST with President Lagarde, who will comment on the bankers' decision and hint at further plans for ongoing monetary policy in the eurozone.

Eurozone - ECB decision. Deposit rate: Actual: 3.5%. Expected: 3.5% Previously: 3.75%

ECB decision commentary:

- ECB will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration.

- The ECB is not pre-committing to a particular rate path.

- Recent inflation data have come in broadly as expected, and latest ECB staff projections confirm previous inflation outlook

- ECB cuts growth forecasts for every year through 2026

- Inflation is expected to rise again in the latter part of this year.

- Staff project that the economy will grow by 0.8% in 2024, rising to 1.3% in 2025 and 1.5% in 2026.

- Staff see headline inflation averaging 2.5% in 2024, 2.2% in 2025 and 1.9% in 2026, as in June projections.

- Traders trim ECB rate bets, price 36bps more cuts by the year-end.

Euro gained in value against the US dollar shortly after ECB decision.

Source: xStation

Source: XTB

Source: XTB