BREAKING: EURUSD gains after PCE data 📌

01:30 PM GMT, United States - Inflation Data for September:

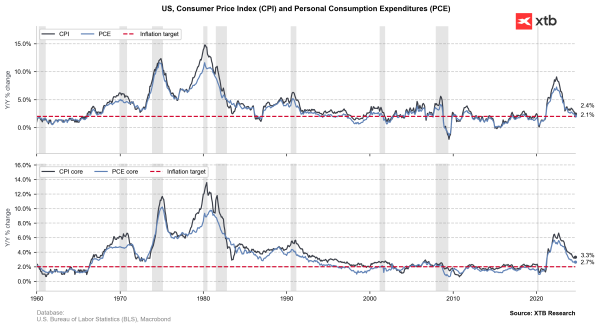

- PCE price index: actual 0.2% MoM; forecast 0.2% MoM; previous 0.1% MoM;

- PCE Price index: actual 2.1% YoY; forecast 2.1% YoY; previous 2.2% YoY;

- Core PCE Price Index: actual 0.3% MoM; forecast 0.26% MoM; previous 0.1% MoM;

- Core PCE Price Index: actual 2.7% YoY; forecast 2.6% YoY; previous 2.7% YoY;

- Personal Income: actual 0.3% MoM; forecast 0.3% MoM; previous 0.2% MoM;

- Personal Spending: actual 0.5% MoM; forecast 0.4% MoM; previous 0.2% MoM;

- Real Personal Consumption: actual 0.4% MoM; previous 0.1% MoM;

In September 2024, U.S. PCE inflation data showed mixed signals, with the headline PCE price index rising 0.2% MoM as expected, while the core PCE increased by 0.3% MoM, slightly above the forecast of 0.26%. The year-over-year headline PCE moderated to 2.1% from 2.2%, while core PCE remained steady at 2.7%, above the projected 2.6%. Personal income grew in line with expectations at 0.3% MoM, while personal spending showed stronger momentum at 0.5% MoM, exceeding the forecast of 0.4%. Real personal consumption demonstrated robust growth at 0.4% MoM, a significant improvement from the previous 0.1%.

The higher-than-expected core PCE reading and strong consumer spending might raise concerns about persistent inflation pressures, potentially complicating the Fed's path to rate cuts. However, the moderating headline year-over-year figure provides some relief. Markets will closely monitor upcoming employment data and inflation trends for further clarity on the Fed's policy trajectory. The combination of robust spending and sticky core inflation could lead to a more cautious approach in the Fed's rate cut considerations.

EURUSD showed 0.1% move upward after the US jobless claims and PCE data. Source: xStation