BREAKING: EURUSD gains after PPI data 🧭

01:30 PM BST, United States - Inflation Data for September:

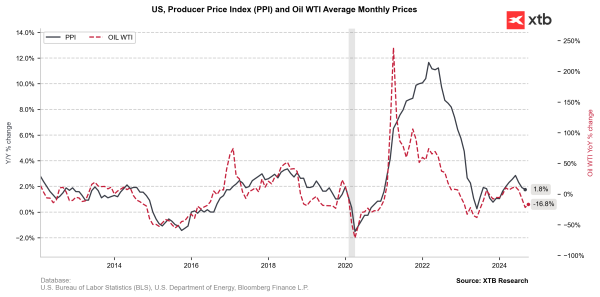

- PPI: actual 1.8% YoY; forecast 1.6% YoY; previous 1.7%

- PPI Core: actual 2.8% YoY; forecast 2.6% YoY; previous 2.4%

- PPI: actual 0.0% MoM; forecast 0.1% MoM; previous 0.2%

- PPI Core: actual 0.2% MoM; forecast 0.2% MoM; previous 0.3%

The U.S. Producer Price Index (PPI) remained flat at 0.0% month-over-month in September, falling short of the 0.1% forecast and lower than the previous month's 0.2%. The year-over-year PPI rose 1.8%, exceeding expectations of 1.6%, while core PPI increased 0.2% month-over-month and 2.8% year-over-year. Notable contributors to the September figures included a 1% surge in food costs (the largest since February) and a 3% increase in deposit services prices. This data suggests a slowdown in producer price increases, which could potentially lead to slower consumer price inflation and influence the Federal Reserve's monetary policy decisions. The lower-than-expected PPI might be interpreted as bearish for the U.S. dollar and could reduce the likelihood of aggressive interest rate hikes. However, this data point should be considered alongside other economic indicators to gauge the overall health of the U.S. economy. There is currently 87.9% probability of 25 bps. rate cut, up from 83.3% yesterday.

EURUSD has reversed gains after data realease and is now trading 0.1% lower. It has broken through 38.2% Fibo and is approaching resistance at 23.6% Fibonacci retracement level. If broken, there might occur retest of yesterday's lows. Source: xStation