BREAKING: GBP drops after dovish UK CPI print

UK CPI inflation report for July was released this morning at 7:00 am BST. Report was expected to show an acceleration in headline price growth as well as slight deceleration in core price growth.

Actual report turned out to be a dovish surprise with headline price growth accelerating less than expected and core price growth slowing more than expected. Both monthly readings also came in lower than expected. Money markets are now pricing in an almost 50% chance of BoE delivering a 25 basis point rate cut at September meeting, up from around 35% before the CPI data release.

GBP took a hit following the release, with GBPUSD reversing from the 1.2850 area and dropping around 0.2-0.3% in a knee-jerk move.

UK, CPI inflation report for July

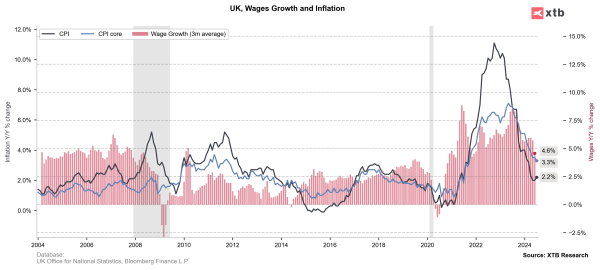

- Headline (annual): 2.2% YoY vs 2.3% YoY expected (2.0% YoY previously)

- Headline (monthly): -0.2% MoM vs -0.1% MoM expected (+0.1% MoM previously)

- Core (annual): 3.3% YoY vs 3.4% YoY expected (3.5% YoY previously)

- Core (monthly): +0.1% MoM vs +0.2% MoM expected (+0.2% MoM previously)

Source: xStation5

Source: xStation5