BREAKING: PMI below consensus, ISM non-manufacturing above expectations 📣

2:45 PM BST, United States - PMI Data for September:

- S&P Global Composite PMI: actual 54; forecast 54.4; previous 54.4

- S&P Global Services PMI: actual 55.2; forecast 55.4; previous 55.4;

03:00 PM BST, United States - ISM Data for September:

- ISM Non-Manufacturing Prices: actual 59.4; forecast 56.0; previous 57.3;

- ISM Non-Manufacturing Employment: actual 48.1; forecast 50; previous 50.2;

- ISM Non-Manufacturing New Orders: actual 59.4; forecast 52.5; previous 53;

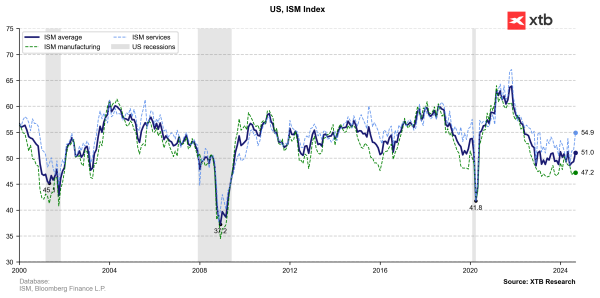

- ISM Non-Manufacturing PMI: actual 54.9; forecast 51.7; previous 51.5;

The U.S. services sector activity reached a 1.5-year high in September, with the ISM nonmanufacturing PMI rising to 54.9. This indicates strong economic growth, particularly in new orders. The data suggests the economy maintained momentum from Q2 into Q3, with GDP estimated to have grown at a 2.5% annualized rate. While employment in the services sector slowed, overall job growth remains steady. The Federal Reserve recently cut interest rates and is expected to make further cuts in the coming months.

EUR/USD is approaching its September low, forming a potential reverse head and shoulders pattern on the daily chart. The RSI is trending lower, favoring bears, while the MACD indicates weakness in the pair. Better-than-expected data offer hope that future rate cuts may be smaller than anticipated, with a 25 basis point cut still in play.