BREAKING: Powerful rebound of gas prices. A possible production cut in play

The strong rebound of gas prices on the day before the rollover is linked to recent announcements from upstream companies in the US. Companies such as Atero Resources, Comstock Resources and, most notably, Chesapeake Energy intend to sharply reduce production this year in response to low prices. The reduction in production is expected to be around 3-5% for these producers, while the reduction in investment in the form of reduced drilling activity is expected to be between 20 and 25%.

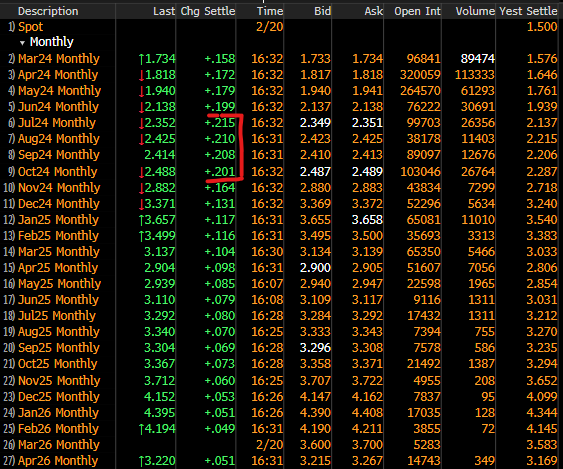

If we see a clear cut in short positions after this news, the price bottom may be behind us. At the same time, we are seeing larger increases at the further end of the curve, primarily in the summer and early autumn, when the actual reduction in production is expected to occur.

The largest increases are seen in the July-October contracts. Source: Bloomberg FInance LP, XTB

Since 09:00 pm GMT yesterday, the gas price has risen by more than 10%, encountering the first barrier in the form of the 14-period average. It is worth remembering that tomorrow the price will open almost 10 cents higher. If the gap does not close and the price closes above the 14-period average, it is possible that the bottom will be behind us. It is worth noting that we had a similar situation a year ago. Exactly on 23 February, the 14-period average was broken and the price subsequently rose by 23%, reaching a price peak at the beginning of March. An increase of 23% from the current price would mean reaching the area of USD 2.2/MMBTU to the retracement of 38.2 of the last downward wave.

Source: xStation5