BREAKING: Retail Sales higher than expected, EURUSD dips 🎯

01:30 PM BST, United States - Retail Sales Data for July:

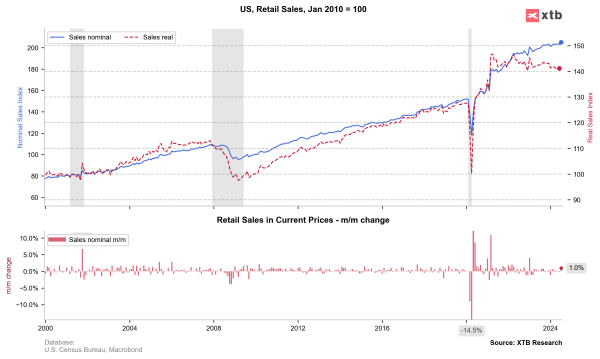

- Retail Sales: actual 1.0% MoM; forecast 0.4% MoM; previous -0.2% MoM;

- Retail Sales: actual 2.66% YoY; previous 2.28% YoY;

- Core Retail Sales: actual 0.4% MoM; forecast 0.1% MoM; previous 0.5% MoM;

- Retail Control: actual 0.3% MoM; previous 0.9% MoM;

01:30 PM BST, United States - NY Empire State Manufacturing Index for August:

- actual -4.70; forecast -5.90; previous -6.60;

01:30 PM BST, United States - Employment Data:

- Jobless Claims 4-Week Avg.: actual 236.50K; previous 241.00K;

- Initial Jobless Claims: actual 227K; forecast 236K; previous 234K;

- Continuing Jobless Claims: actual 1,864K; forecast 1,880K; previous 1,871K;

Macro data from the US came in really strong. Retail sale in July was well above analysts' expectations and despite a downside revision of sales for the previous June, we are seeing significant increases. Moreover, weekly jobless claims fell again, returning to a range below 230k.

The data was positively received by the market. In the first reaction after the publication, the USD gains strongly in anticipation of a more hawkish Fed stance. On the other hand, the strong sell-off supports investors' hopes for a soft landing without a recession. That is why we are seeing strong gains on equity indices and the cryptocurrency market.