BREAKING: UK CPI and PPI lower than expected. GBPUSD lower after the data

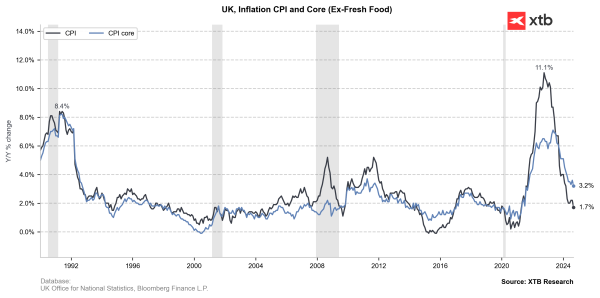

UK CPI in September came in 1.7% YoY vs 1.9% exp. and 2.2% previously (0.0% MoM vs 0.1% exp. and 0.3% previously)

UK Core CPI came in 3.2% YoY vs 3.4% exp. and 3.3% previously (0.1% MoM vs 0.4% previously)

UK PPI output prices came in lower than expected with -0.7% YoY vs -0.6% exp. and 0.2% previously (-0.5% MoM vs -0.3% exp. and -0.3% previously)

UK PPI input prices dropped -2.3% YoY vs -2.2% exp. and -1.2% previously (-1.0% MoM vs -0.6% exp. and -0.5% previously)

Inflation in UK has dropped sharply to 1.7% in September and is below the Bank of England's 2% target rate first time since April 2021. Economists were expecting 1.9% inflation print.

GBPUSD reacted swiftly to the news and is currently approaching support at 38.2% FIbonacci retracement level. Succesful breakdwon can lead to increased bearish momentum