BREAKING: US GDP lower than expected. US100 loses

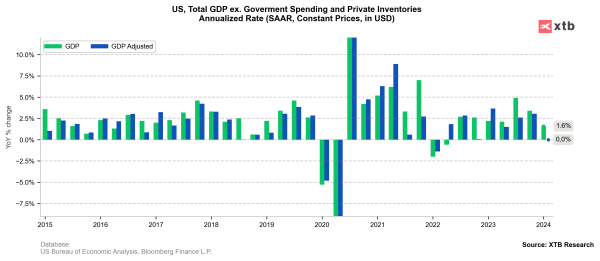

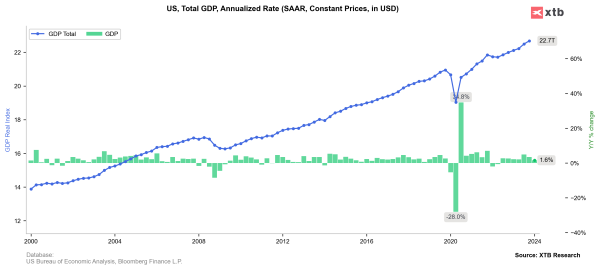

US GDP (Q1) QoQ advance: 1.6% vs 2.5% exp. and 3.4% previously (GDP deflator seasonally adjusted: 3.1% vs 1.7% previously)

- US GDP price index: 3.1% vs 3% exp. vs 1.6% previously

- US Core PCE prices advance: 3.7% vs 3.4% exp. vs 2% previously

US jobless claims: 207k vs 215 k exp. and 212 k.previously

- Continued jobless claims: 1,781 k vs 1,8135 k exp. vs 1,812 k previously

US Wholesale inventories: -0.4% vs 0.3% MoM vs 0.5% previously

- Retail inventories: -0.1% vs 0.4% previously

US Advance goods trade balance: -91,83 bln USD vs -91 bln USD exp. and -90,3 bln USD previously

US100 loses after the important US data

After weaker than expected GDP data with very low jobless claims and higher than expected price index, futures on Nasdaq 100 (US100) weakened as traders expect Fed members to be pressured and hawkish, despite not as strong as expected American economy momentum. The biggest risk is of course as higher prices meaning inflationary pressure.

Source: xStation5

Source: xStation5

Source: US Bureau of Economic Analysis, Bloomberg Finance LP, XTB Research

Source: US Bureau of Economic Analysis, Bloomberg Finance LP, XTB Research

Source: US Bureau of Economic Analysis, Bloomberg Finance LP, XTB Research

Source: US Bureau of Economic Analysis, Bloomberg Finance LP, XTB Research