BREAKING: USD gains after US Q2 GDP data

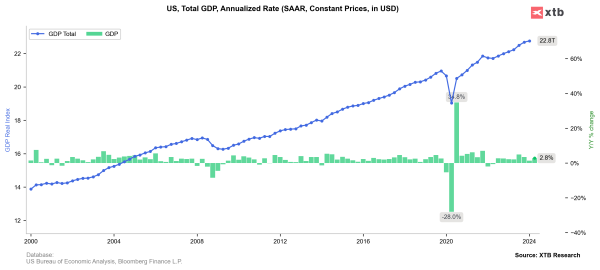

A large economic data pack from the United States was released today at 1:30 pm BST. Among data released one can find flash GDP report for Q2 2024, as well as durable goods orders for June and weekly report on jobless claims. Of course, it was GDP report that drew the most attention. Market was expecting an acceleration in annualized US GDP growth from 1.4% in Q1 to 2.0% now, while headline and core PCE inflation was seen slowing from first quarter's dynamics.

GDP report turned out to be a positive surprise, with annualized growth accelerating to 2.8% in Q2 2024. Personal consumption also surprsie to the upside. Headline PCE came in lower than expected, while core PCE came in higher than expected.

A big miss was reported in headline US durable goods orders for June, although less volatile core measure (ex-transport) surprised to the upside.

US dollar gained on the news as the data does not support an urgent need for near-term rate cuts. However, while Fed cut at July meeting is unlikely, cut at September meeting remains a base case scenario. Interestingly, US indices also moved higher following the release.

US, GDP report for Q2 2024

- GDP growth (annualized): 2.8% vs 2.0% expected (1.4% previously)

- PCE: 2.3% QoQ vs 2.6% QoQ expected (3.1% QoQ previously)

- Core PCE: 2.9% QoQ vs 2.7% QoQ expected (3.7% QoQ previously)

- Personal consumption (annualized): 2.3% vs 2.0% expected (1.5% previously)

US, durable goods orders for June

- Headline: -6.6% MoM vs +0.3% MoM expected (+0.1% MoM previously)

- Ex-transport: +0.5% MoM vs +0.2% MoM expected (-0.1% MoM previously)

US, jobless claims

- Initial jobless claims: 235k vs 239k expected (243k previously)

- Continuing jobless claims: 1851k vs 1868k expected (1867k previously)

Source: xStation5

Source: xStation5