BREAKING: USD jumps after retail sales data

US retail sales report for March was released today at 1:30 pm BST. Report was expected to show another month of strong growth, although headline sales were expected to grow slower than in February.

Actual report turned out to be a positive surprise with retail sales increasing more than expected in all major categories. Especially big beats were spotted in core and core-core categories.

New York Fed manufacturing index for April was also released simultaneously. It was expected to show an improvement compared to March reading. While it did show an improvement, it was much smaller-than-expected.

Nevertheless, strong beat in retail sales figures is driving the market reaction, with USD gaining strongly. US equity futures pulled back, and so did gold.

US, retail sales for March

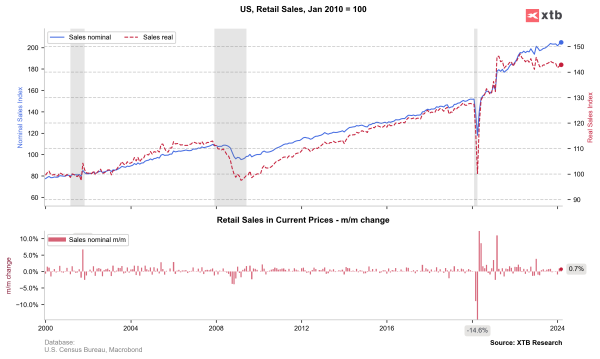

- Headline: 0.7% MoM vs 0.3% MoM expected (0.6% MoM previously)

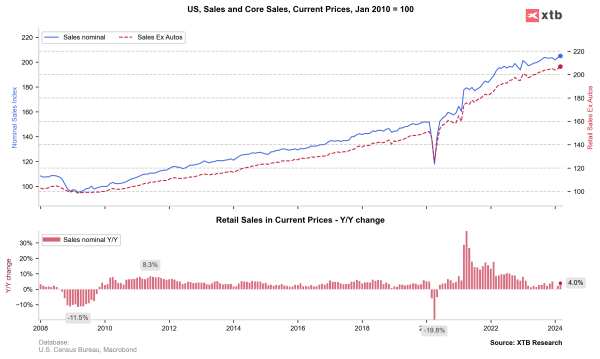

- Ex-autos: 1.1% MoM vs 0.4% MoM expected (0.3% Mom previously)

- Ex-autos and fuel: 1.0% MoM vs 0.3% MoM expected (0.3% MoM previously)

US, New York Fed manufacturing index for April: -14.3 vs -7.5 expected (-20.9 previously)

Source: xStation5

Source: xStation5