CAD: Rally at Odds with Fundamentals

Key points:

- Sharp Gains in CAD: The Canadian dollar has surged nearly 3% against the US dollar in August, driven by a dovish shift in the Fed outlook and potential short covering by traders who had record short positions.

- Record Short Positioning: The rally has been partly fueled by short covering, as traders unwound their positions amid the weakening USD, adding momentum to the CAD’s gains.

- Fundamentals Suggest Weaker CAD Ahead: The Bank of Canada’s expected aggressive rate cuts and deteriorating economic outlook could undermine the CAD. Worsening yield differentials, potential USD correction, and technical oversold conditions suggest that current CAD gains might not be sustainable.

--------------------------------------------------------------------------------------------------------------

Why is the CAD Rallying?

Fed’s Rate Outlook

At the Jackson Hole conference, Federal Reserve Chair Jerome Powell hinted that rate cuts might begin as early as September, with a particular focus on the worsening labor market. He also left the door open for a potential 50bps cut, which has significantly weakened the USD. This has fueled gains across all G10 currencies, including the CAD. Since early August, when the U.S. July jobs report bolstered the case for Fed easing, the USD has experienced notable weakness. Although the CAD has benefited from this, it still trails behind other G10 currencies.

Short Covering

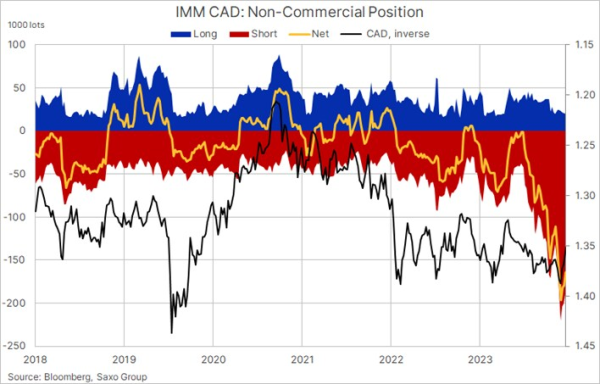

The CAD rally is partly driven by a wave of short covering. Positioning data from the Commodity Futures Trading Commission (CFTC) indicates that the net short position in Canadian dollar futures may have reached record levels in late July. Traders had heavily shorted the CAD, anticipating a divergence between the easing cycles of the Federal Reserve and the Bank of Canada. The BoC has already cut rates twice this year and is expected to continue easing, while the Fed’s actions were seen as more uncertain.

However, as the U.S. dollar weakened and the CAD began to rise, these short positions became increasingly untenable. Traders who bet against the CAD were forced to unwind their positions, leading to a sharp reversal. This has been evident in the CFTC positioning update for the week of 20 August where net short positioning in CAD dropped from $14bn in the week of 30 July to $12bn. This process, known as short covering, has added considerable momentum to the CAD’s recent strength.

Higher Oil Prices

Rising oil prices are boosting the loonie, thanks to Canada's substantial oil export revenues. This week, crude oil has gained fresh momentum due to escalating tensions in the Middle East and potential supply disruptions in Libya. Additionally, the Fed’s rate cut outlook has led markets to anticipate that US demand won't collapse.

Risks to the Rally

Bank of Canada’s Rate Cuts

The Bank of Canada (BoC) may cut rates more aggressively than expected. The market anticipates the BoC will lower its benchmark rate to 4.25% in September, with further reductions potentially bringing it to 3% by next July. Such cuts could undermine the CAD’s rally by narrowing yield differentials.

Technical Indicators Pointing to Oversold Levels

USDCAD is trading far below its 200-day moving average. The bearish tone has seen the USDCAD pair hit lower lows and breaking below its lower Bollinger Band, pushing deeper into oversold territory. This technical setup suggests the potential for a correction or at least a pause in the rally.

Risk Taking Could Remain Limited

With ongoing global uncertainties, risk appetite could remain subdued, limiting the loonie’s upside potential. Concerns about global economic growth, geopolitical tensions, and the Fed's monetary policy could make investors cautious, dampening demand for risk-sensitive assets like the CAD.

Scope for USD Correction

The CAD has lagged in month-to-date gains against the USD, and the recent USD selling may have gone overboard. With the USD looking structurally cheap amid lingering geopolitical uncertainties, weaker global growth prospects, and the uncertain outlook for the US elections, a USD recovery could hurt the CAD. Yield differentials suggest that the CAD could be the most vulnerable currency in the G10 FX space if the USD strengthens.

What to Watch

- Canada’s Payroll Employment Report (Thu): This report will offer insights into Canada’s labor market, a crucial factor for BoC rate decisions. Watch for any signs of moderating wage growth alongside headline job growth, as this could influence BoC's policy trajectory.

- Canada’s GDP Data (Fri): The GDP data will be critical in assessing the health of the Canadian economy and will impact both BoC policy and CAD performance. A significant miss on Q2 GDP growth could increase pressure on the BoC to consider a larger (50bp) rate cut, although such a move remains unlikely given ongoing inflation risks.

- US Data Releases: Key U.S. economic reports, including PCE (Aug 30) should be closely monitored for potential shifts that could affect USDCAD.

--------------------------------------------------------------------------------------------------------------

Disclaimer:

Forex, or FX, involves trading one currency such as the US dollar or Euro for another at an agreed exchange rate. While the forex market is the world’s largest market with round-the-clock trading, it is highly speculative, and you should understand the risks involved.

FX are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading FX with this provider. You should consider whether you understand how FX work and whether you can afford to take the high risk of losing your money.

Recent FX articles and podcasts:

- 21 Aug: US Dollar: Excessive Weakness or More to Come?

- 16 Aug: FX Markets Face a Tug-of-War: A Scenario Analysis

- 14 Aug: NZD: Rate Cut Cycle Has Kicked Off

- 7 Aug: JPY: BOJ’s Back to Being Dovish – Can it Cool the Yen Short Squeeze?

- 6 Aug: AUD: Hard to Buy in RBA’s Hawkishness

- 1 Aug: GBP: Bank of England Cut Won’t Damage Pound’s Resilience

- 31 Jul: JPY: BOJ’s Hawkish Policy Moves Leave Yen at Fed’s Mercy

- 31 Jul: AUD: Softer Inflation to Cool Rate Hike Speculation

- 26 Jul: US PCE Preview: Key to Fed’s Rate Cuts

- 25 Jul: Carry Unwinding in Japanese Yen: The Current Dynamics and Global Implications

- 23 Jul: Bank of Canada Preview: More Cuts on the Horizon

- 16 Jul: JPY: Trump Trade Could Bring More Weakness

- 11 Jul: AUD and GBP: Potential winners of cyclical US dollar weakness

- 3 Jul: Yuan vs. Yen vs. Franc: Shifting Carry Trade Strategies

- 2 Jul: Quarterly Outlook: Risk-on currencies to surge against havens

Recent Macro articles and podcasts:

- 15 Aug: Warren Buffett’s Portfolio Shifts: New Bets, Big Buys, and Surprising Exits

- 15 Aug: US CPI: Fed Rate Cut Remains in Play, but 25 vs. 50bps Debate Unsettled

- 13 Aug: US inflation preview: Is it still too sticky?

- 8 Aug: US Economy: Soft Landing Hopes vs. Hard Landing Fears

- 2 Aug: Singapore REITs: Playing on Potential Fed Rate Cuts

- 30 Jul: Bank of Japan Preview: Exaggerated Expectations, and Potential Impact on Yen, Equities and Bonds

- 29 Jul: Potential Market Reactions to the Upcoming FOMC Meeting

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

Weekly FX Chartbooks:

- 26 Aug: Weekly FX Chartbook: Powell Keeps the Door for 50bps Rate Cut Open

- 19 Aug: Weekly FX Chartbook: Over to Policymakers – Fed’s Powell, Kamala Harris, and BOJ’s Ueda in Focus

- 12 Aug: Weekly FX Chartbook: Case for Outsized Fed Cut Bets to be Tested

- 5 Aug: Weekly FX Chartbook: Dramatic Shift in Market Narrative

- 29 Jul: Weekly FX Chartbook: Mega Week Ahead - Fed, BOJ, Bank of England, Australia and Eurozone CPI, Big Tech Earnings

- 22 Jul: Weekly FX Chartbook: Election Volatility and Tech Earnings Take Centre Stage

- 15 Jul: Weekly FX Chartbook: September Rate Cuts and the Rising Trump Trade

- 8 Jul: Weekly FX Chartbook: Focus Shifting Back to Rate Cuts

- 1 Jul: Weekly FX Chartbook: Politics Still the Key Theme in Markets

FX 101 Series:

- 26 Aug: Navigating Portfolio Risks Amid Weakening U.S. Dollar

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar