Capex growth to fall sharply for states, Bihar and five others to witness contraction

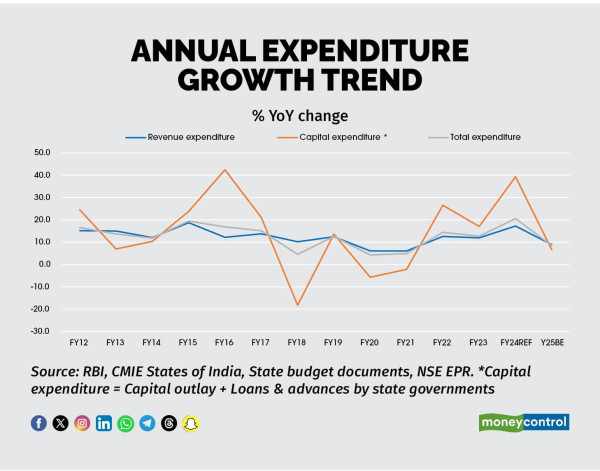

Indian states’ capital spending surge is likely to taper off in the current fiscal with growth moderating to 6.4 percent from 39.3 percent as per revised estimates for FY24, according to an analysis of 21 states which comprise 95 percent of India’s GDP by National Stock Exchange’s Economic Policy and Research Department.

The moderation in states’ capex is sharper than the central government, which is expected to spend Rs 11.1 lakh crore on capital projects this year, up 17 percent from the previous fiscal. The central government’s capital spending had surged 28.2 percent in FY24, pushing growth beyond 8 percent.

The slowdown in capex spending is also likely to affect state economies, with nominal growth easing 1.4 percentage points to 10.2 percent in FY25 from 11.6 percent in the previous fiscal year.

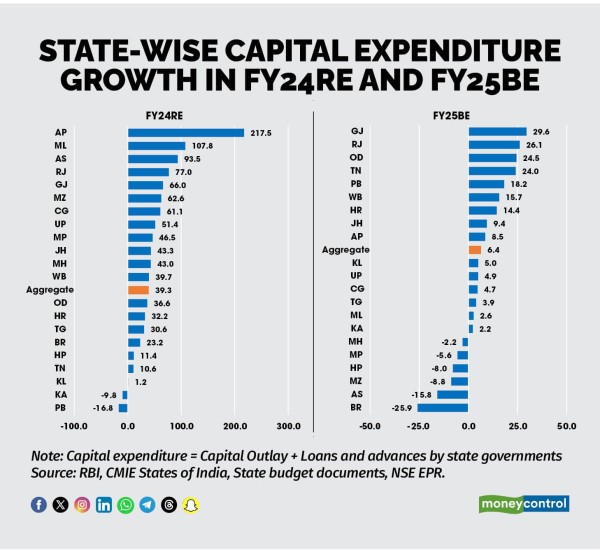

A Moneycontrol analysis shows that poorer states, which need higher capital investment, are expected to witness a contraction in capex spending, while the richer states are expected to charge ahead with higher capex.

In FY25, six out of 21 states, including Bihar and Madhya Pradesh, have budgeted a contraction in capital expenditures.

On the other hand, Gujarat, Rajasthan, Odisha, and Tamil Nadu, are expected to witness an over 20 percent growth in capex spending.

States that have pivoted to cash transfers are also expected to witness a contraction or substantial slowdown in capex spending. Maharashtra, for instance, which recently announced an income transfer scheme for financially needy women, is expected to witness a contraction of 2.2 percent in capex spends compared with 43 percent in FY24.

The state is headed for elections in November.

More for interest and pensions

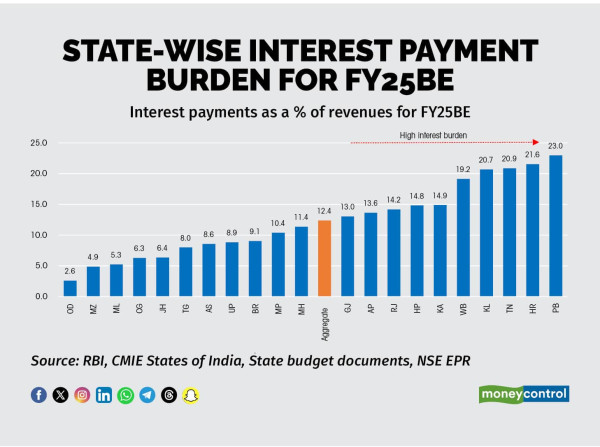

Committed expenditure growth, a portion of revenue expenditure that consists of interest payments, spending on salaries and wages, pensions and subsidies, will remain steady around 10.2 percent in FY25.

As a result of a high interest burden, states like Punjab, Kerela and West Bengal have a high share

of committed expenditure, leaving little space for capital expenditure. While Odisha and

smaller states like Jharkhand and Mizoram have pushed their capital spending in the last three years.

The moderation in expenditure growth is likely to be broad-based, impacting both revenue expenditures and capital expenditures.

The study found that the total expenditure for the 21 states under review will grow at 8.5 percent in FY25BE, a sharp decline from the 20.6 percent growth record in FY24RE. The sputtering growth rate comes as revenue receipts dwindle and transfers from the Central Government reduce.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.