Central banks preview: Fed, ECB and BoE on the radar this week

It’s a busy week ahead for the central bank calendar, with 5 major central banks set to report on their monetary policy. The two-day showdown will be kicked off by the Federal Reserve (Fed) on Wednesday, followed by the European Central Bank (ECB), Bank of England (BoE), Swiss National Bank (SNB) and Norges Bank (Norway) on Thursday. The consensus is that all of them will keep their rates unchanged at current levels.

Federal Reserve – Current rate: 5.25% - 5.5%

Before the Fed meeting on Wednesday, we will see the US CPI data for November. According to Reuters data, markets anticipate a drop in year-over-year headline inflation to 3.1% from 3.2%, with core inflation remaining unchanged at 4%. Given the unexpected drop in unemployment in the US in November, a stronger CPI reading could skew market expectations about the future path of rates from the Fed – more specifically, when the first rate cut takes place – which will likely have an impact on markets heading into the meeting on Wednesday.

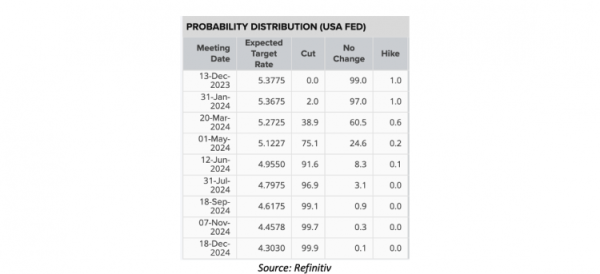

As per Reuters’ data, current market pricing shows a 99% probability of no change for the Fed meeting on Wednesday. This means the meeting could be a non-event, but the messaging from Powell is likely going to be the main driver of any market volatility post-event. It is also important to note that this meeting comes with updated economic forecasts and dot plot, which will give markets a clearer picture of where the FOMC expects rates to end up over the coming years.

Fed probability distribution - Source: refinitiv

Fed probability distribution - Source: refinitiv The latest commentary we got from Powell before the blackout period remained hawkish in tone, as he continued to suggest possible further rate hikes if the data deemed so necessary. It is highly unlikely we will see further rate hikes, and the markets know that given the reaction after the commentary. But the data since then has shown an unexpected tightening in the labour market, and so, depending on how the CPI evolves in November, Powell may ramp up the hawkish tone on Wednesday just to make sure he doesn’t allow monetary conditions to loosen further before he intends them to as yields drop. If so, this could give the USD enough reason to keep up the recent recovery from 3-month lows.

US Dollar Index daily chart

source: tradingview

source: tradingview Past performance is not a reliable indicator of future results.

Bank of England – Current rate: 5.25%

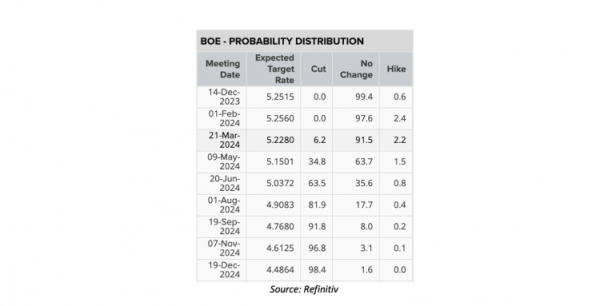

Similar to the Fed, markets are assigning a 99% chance of no change to the Bank of England meeting on Thursday as per data from Reuters. Inflation has also dropped significantly in the UK in the past few months, but it is still significantly higher than in the US, which has led markets to believe the BoE will have to hold out longer before it can start cutting rates.

BoE probability distribution - Source: refinitiv

BoE probability distribution - Source: refinitiv Headline inflation grew 4.6% in the year to October, a significant drop from 6.7% in the previous month. The data for November will not be released until next week (20 December) but it is unlikely that the drop – if any – will be so big once again. The Bank of England is well aware that the disinflation process is not linear, and consumer prices have been much stickier in the UK than they have been in the US and Europe. The labour market remains tight, and wages continue to put upward pressure on domestic inflation, so there is good reason to expect the BoE to hold out on cutting rates until Q3 or Q4 next year. This may give GBP a slight edge in the coming months as rate differentials play out.

This meeting is likely to also be a non-event, as there will be no monetary policy report at this meeting. There may be some remaining volatility from the Fed meeting the day prior, which could give GBP/USD some further momentum. A stronger USD on the back of a more hawkish Fed will likely weigh on GBP/USD even if the BoE keeps rates on hold. Alternatively, a weaker USD may see the pair pushing above 1.26 once again. Focus will then rapidly shift to the UK CPI release the following week as that will likely drive most of the momentum in GBP.

GBP/USD daily chart

source: tradingview

source: tradingview Past performance is not a reliable indicator of future results.

European Central Bank – Current rate: 4%

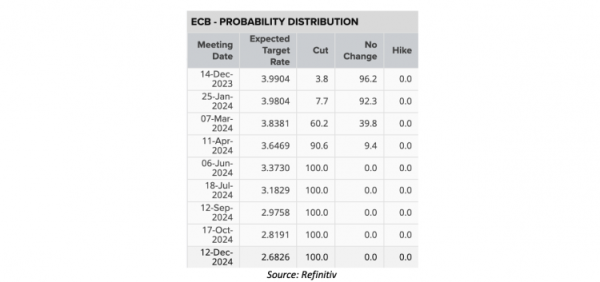

Data from Reuters shows markets are currently pricing in a 96% chance of no change at the meeting on Thursday. But, unlike the Fed and the BoE, the remaining 4% is not assigned to the possibility of a hike, but to a 25bps rate cut. It seems highly unlikely that it would happen at this meeting, but the fact that markets are even pricing it in as a possibility suggests how much more dovish they are about the ECB.

ECB probability distribution - Source: refinitiv

ECB probability distribution - Source: refinitiv The fact is that recent data from the Eurozone has suggested the economy is slowing at a faster pace than in the US. Compared to the UK, growth remains on similar terms, but inflation is much lower in the Eurozone – currently at 2.4% – which has led markets to price in a higher chance that the ECB will be the first out of the three to cut rates. Current predictions are pointing to April for the first 25bps cut as per data from Reuters.

As per the meeting on Thursday, markets are likely going to be paying close attention to President Lagarde and whether she acknowledges the faster-than-anticipated drop in inflation and how that fits into the central bank’s rate forecasts. Whilst equities could get a boost from a more dovish ECB, the mention of rate cuts could send the EUR down even further against the USD and GBP. For now, EUR/USD seems to have found some support from the recent selloff. But with the RSI having dipped below 50, the path of least resistance could turn lower if the markets continue to price in a dovish ECB.

EUR/USD daily chart

source: tradingview

source: tradingview Past performance is not a reliable indicator of future results.