Chart of the day: AUDUSD (24.04.2024)

The Australian dollar is the best performing currency in the broad FX market today on the back of a higher-than-expected CPI inflation reading. Inflation rose 3.6% year-on-year in the first quarter, stronger than the 3.4% result the market was expecting. Continued upward pressure on the price of goods and services in the economy is modifying market assumptions about the path of interest rates in Australia.

Inflation on a quarterly basis rose from 0.6% in Q4 to 1.0% in Q1. Measures of core inflation, which the RBA closely tracks, also showed signs of rising price pressures: the weighted average accelerated from 0.9% to 1.1% q/q

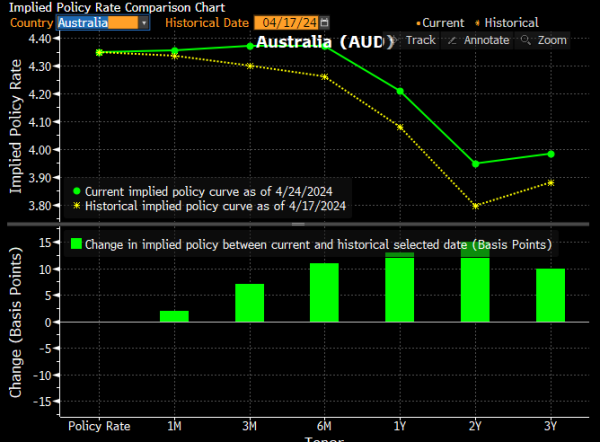

In view of the ABS's hawkish inflation report, the implied curve of the interest rate path was significantly modified. The market is assuming a clearly more conservative attitude of bankers regarding possible rate cuts.

Source: Bloomberg Financial LP

The AUDUSD pair today tested the barrier of the 200-period EMA (golden curve), which in the past has been a rather important control point for the pair's quotations. Source: xStation 5