Chart of the day: Bitcoin (08.08.2024)

Cryptocurrencies are having a turbulent time. On Monday, we witnessed a massive slide in cryptocurrency prices, which reached up to 17% with its range. In the end, however, the downward pressure managed to stop somewhat, and in intraday terms we saw a 7% drop. Since then, bitcoin has stabilized somewhat and is trading slightly below the key resistance zone set by the 200-day exponential moving average (golden curve in the chart below).

Further cryptocurrency trading will depend on several factors. First, recent polls suggest that Donald Trump's support has declined sharply, with Kamala Harris coming out on top in blunt fashion. It is worth remembering that in the eyes of investors it is the Republican candidate who is positioned as the biggest supporter of digital assets. Using his own words, Trump recently hinted that if elected US president, the United States would become a "BTC superpower." A drop in the odds of Trump's win could therefore weaken the crypto market in the near term.

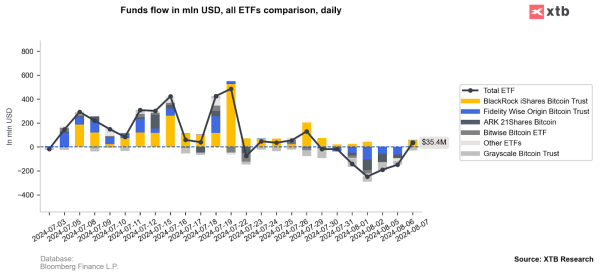

Secondly, data on inflows into ETFs indicate that despite BTC's rebound, it was not driven by investors allocating funds in such funds looking for cheaper bargains. Since the beginning of the week we have seen a lot of net outflows of funds, nevertheless yesterday's session changed this picture somewhat (chart below).

Source: XTB

Thirdly, a key factor will be whether fears of a global recession actually materialize, pushing risky assets down with it. In this aspect, an important factor may be today's jobless claims data, which, in the absence of other significant macro readings, is one of the most important macro reports of the week.

Source: xStation