Chart of the day - Bitcoin (10.09.2024)

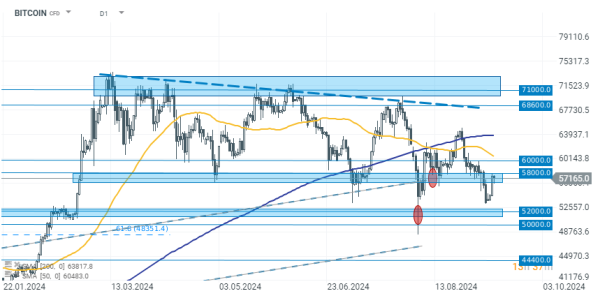

Bitcoin reduces losses from the first part of today and returns above $57,000. By the time of publication in September, the price of Bitcoin had fallen by 3.3%, slightly below the historical average.

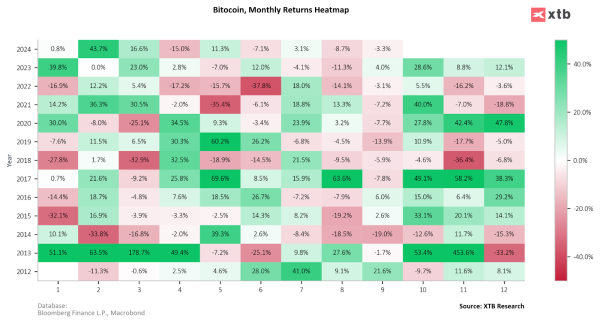

September is seasonally the least volatile month in the broader financial market, and this is also the case in the cryptocurrency market. Volatility is low, and so is liquidity. Under such conditions, bored investors tend to close open positions, causing declines. Over the past 13 years since the beginning of Bitcoin, only in four years was September a month of growth. Currently, including yesterday's gains, Bitcoin is quoted 3.3% lower, although excluding just yesterday this decline would have amounted to 10%.

However, after a bearish September, October looks quite optimistic. Only three months over the span of 13 years ended in the negative, and in the others, the price recorded impressive double-digit rebounds.

Currently, the main concern for investors remains high interest rates and the risk of recession. Although global liquidity is slowly returning to the markets, the issue of a soft landing is not yet decided. This uncertainty is further supported by the fact that Bitcoin has never experienced a real slowdown (excluding Covid-19), and it is not entirely clear how it will react to one. In the coming weeks, the most important from the market's point of view seems to be the Fed's communication after the September rate cut and further macroeconomic data from the USA. Nevertheless, increasing global liquidity should sooner or later support Bitcoin prices. Currently, the most important support levels remain $53,000 and the recently broken support around above $56,000.

Source: xStation 5