Chart of the day - COTTON (19.09.2024)

Cotton futures on ICE (COTTON) rebounded from $70 to almost $72 after a strong, yesterday selloff as US hurricane forecasters are watching a new potential storm forming in the Caribbean Sea. As for now, floods and heavy raining hit supply from the important cotton states such as Mississippi and Oklahoma, which will potentially lead to another production cut in October USDA WASDE report.

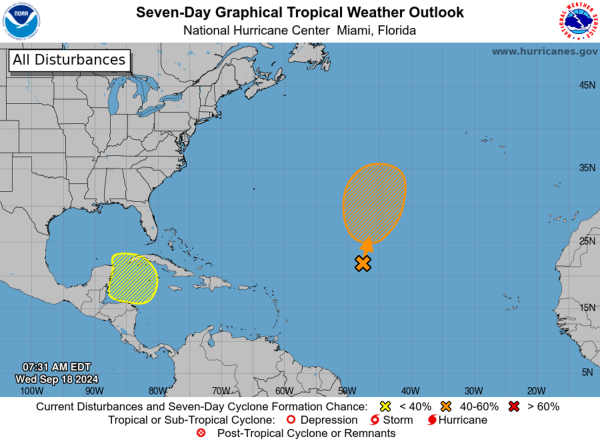

- As for now, Atlantic hurricane season motors past its halfway point, with no exceptional number of storms (7 until now), however hurricanes are above average (4 until now). However, weather analysts have turned attention to the Gulf of Mexico, where an area of low pressure 'could form late this weekend or early next week' according to the National Hurricane Center.

- Current conditions suggest that slow development of the system is possible through the middle of next week. NHC warning was supported by University of Miami, suggesting another storm possibly forming in the western Caribbean, named 'Helene'. According to newest forecasts, previous Tropical Storm Gordon spinned out in the Atlantic, far from US land, however even Gordon can easly regenerate, even next days.

Amid still open US hurricane season, traders may expect higher cotton activity - still dominated by net short Managed Money positions (from the last CoT report). Raining and floods in such states as Oklahoma, Mississippi and Louisiana during cotton crop season with improving global demand conditions may lead to short covering, supporting the trend. However, dropping below $70 per bale, may suggest that market bets are still bearish, ignoring fundamentals.

Source: National Hurricane Center, Source: NOAA