Chart of the day - DE40 (23.09.2024)

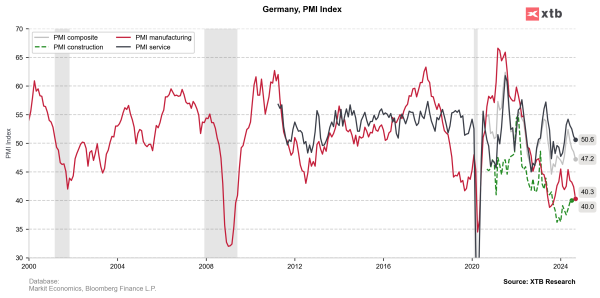

The latest economic data from Germany and the Eurozone has painted a gloomy picture, with manufacturing and composite PMIs in contraction territory. This economic weakness is fueling expectations for faster ECB rate cuts, which could provide a boost to the DAX despite the challenging economic environment.

The DAX has shown resilience in the face of weak economic data, hovering around all-time-high price given the possibility of monetary easing. The recent un-inversion of the German yield curve, with 2-year yields falling below 10-year yields for the first time since November 2022, signals shifting market expectations towards a more accommodative ECB policy. This change in the yield curve dynamics, coupled with disappointing economic indicators, has led to increased bets on faster and deeper rate cuts from the ECB.

September has historically been a challenging month for the DAX. However, October tends to show more positive performance, which could align well with growing expectations of ECB easing.

Investors should brace for heightened volatility in the coming weeks as the market processes the weak economic data and adjusts to evolving ECB policy expectations. The ECB's future guidance and economic projections will be crucial in shaping market sentiment. DAX components, particularly those in cyclical sectors like automotive and industrials, are likely to be highly sensitive to ECB commentary and economic outlook. The manufacturing sector's continued decline is particularly concerning, with output falling at its fastest rate in a year. This downturn is not isolated, as it's beginning to affect Germany's traditionally resilient services sector. The rapid shift from moderate optimism to steep pessimism in just one month underscores the fragility of business sentiment. The ongoing debate about deindustrialization risks in Germany is likely to intensify given these troubling economic indicators. Despite these challenges, there's a glimmer of hope that higher wages combined with lower inflation could potentially stimulate domestic demand and consumption.

The potential for faster rate cuts could provide support to the DAX, especially benefiting sectors that are sensitive to interest rates, such as real estate and utilities. However, ongoing economic weakness, particularly in the manufacturing sector, may continue to weigh on certain DAX components.

DE40 (D1 interval)

The DE40 is currently trading near all-time-highs. The current question is whether the DAX will be able to remain at this level. The first resistance is located at the previous high of 18,987.7. The first key support may be the mid-July peak at 18,862.6. Breaking it down would open the door for bears to test the 23.6% support or even the 50- and 100-day SMAs. Currently, oscillators are giving bulls ground for further upside, with the MACD increasing and the RSI consolidating near oversold levels. However, fundamentals might give bears opportunity to test lower values. Source: xStation