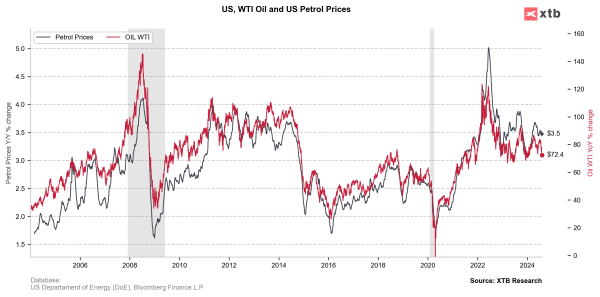

Chart of the day - OIL.WTI (05.08.2024)

WTI crude oil is losing 2.80%, falling below $72 per barrel, erasing the recent risk premium from the escalation of the conflict in the Middle East. The catalyst for the decline is concerns about an upcoming slowdown in the US and a drop in oil demand.

The decline is occurring despite increased geopolitical risk in the Middle East, where tensions related to potential retaliatory actions by Iran against Israel have raised concerns. However, these geopolitical factors were not sufficient to counterbalance the broader market sell-off and fears of economic slowdown, particularly in the US and China.

The low oil prices are favorable for the Fed and the further cooling of inflation in the US. Therefore, recent declines may increase investor expectations regarding the number of interest rate cuts by the Fed later this year.

Oil prices have dropped more than 8.80% over the last three trading sessions since last Thursday. The drop from levels above $78 is currently testing the $72 per barrel mark. Hedge funds have significantly reduced their net long positions in futures contracts, indicating a bearish outlook for the oil market. If the downward pressure continues, the next target range for the current decline could be around $67.50-68.00.

Source: xStation 5