Chart of the day - US100 (21.02.2024)

Wednesday is unquestionably the most interesting day this week from market's perspective. Investors will be offered FOMC minutes at 7:00 pm GMT. The document will relate to the January 30-31, 2024 meeting, during which Fed Chair Powell said that the central bank may not have enough confidence in inflation by the March meeting to cut rates. Traders will look for more hints on what can be seen as 'enough confidence'. However, there will be another event this week, which will be watched even more closely than FOMC minutes release - fiscal-Q4 earnings from Nvidia (NVDA.US). Report will be released after close of the Wall Street session at 9:20 pm GMT and will show whether Nvidia's business performance lived up to the hype that has pushed the company's shares to all-time highs. Expectations going into the report are very high, and failure to deliver on them and provide an optimistic outlook for the coming quarters may be a huge disappointment. Earnings disappointment may put Wall Street rally at risk given that Nvidia was its backbone.

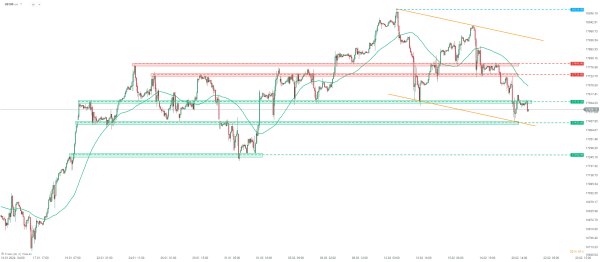

Taking a look at Nasdaq-100 futures chart (US100) at H1 interval, we can see that the index reached fresh record highs in the 18,120 pts area at the beginning of the previous week, but has been struggling since. Index is trading over 3% below recent all-time highs and has broken below the 17,575 pts support zone. A test of the 17,450 pts support area was made yesterday but bears failed to break below it. The aforementioned 17,450 pts area is a key near-term support to watch, given that US100 was unable to break back above 17,575 pts area overnight. A solid report from Nvidia is likely to push the stock, as well as the whole tech sector, higher while a disappointing report may exert strong downward pressure on US100 and push it towards 17,260 pts support.

Source: xStation5

Source: xStation5