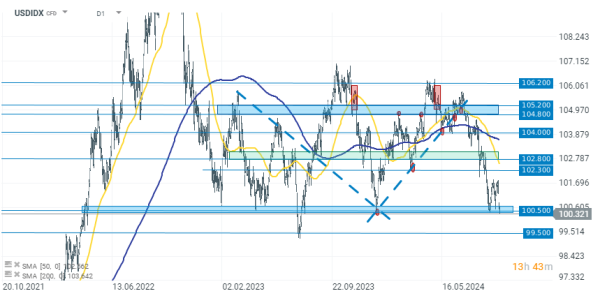

Chart of the day - USDIDX (16.09.2024)

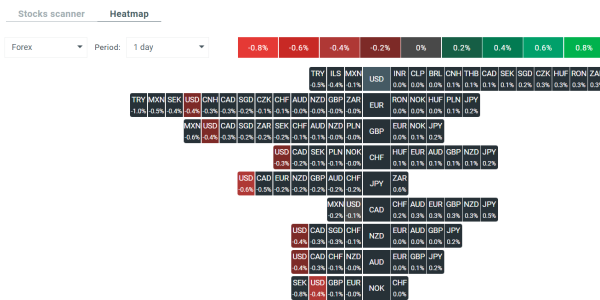

The dollar returns to declines and is today the weakest currency among the G10 currencies. At the time of writing, the USDIDX dollar index is down 0.44% to 100.3300 points. In the last hour, the declines have even accelerated, as earlier in the day USDIDX was down about 0.20-0.25%.

On some currency pairs, the dollar is losing as much as 0.6%. EURUSD is gaining 0.36% to 1.11150, while USDJPY breaks the key level of 140.0000, losing 0.60% to 139.8700.

The dollar sell-off is, of course, driven by the upcoming FOMC meeting, where U.S. interest rates are expected to be cut for the first time in this cycle. Speculation focuses on the scale of the cut, ranging between 25-50 basis points. The weakening dollar is also supporting the prices of other assets, such as gold and stocks. The absence of recession expectations in the coming months is mainly benefiting small-cap companies. The US2000 index, even before the opening of the U.S. cash session, is gaining 0.50%, the most among U.S. indices.

USDIDX (D1)

USDIDX is once again testing the lower boundary of the more than two-year consolidation channel around 100.5000 points. The critical point is the 99.5000 level. If selling pressure persists and breaks through this zone, we can expect much lower levels, last seen in 2021.