Chart of the day - USDIDX (25.09.2024)

The dollar has been under continuous downward pressure since the Fed's dovish pivot last week. Today, we are seeing a retest of the key support level at 100.0000 points. Yesterday, the decline was around 0.40-0.50%, and today the price rebounds slightly, although in the early part of the day there was a brief dip below the 100-point barrier.

The next and last significant support for the dollar is located at 99.5000, which set the lowest level reached in the last three years. The likely decisive catalyst for the next move will be the set of labor market reports next week. However, it's also possible that we will experience greater volatility during Powell's speech on Thursday and the PCE release on Friday.

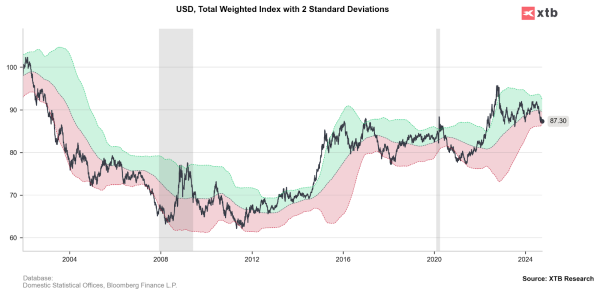

USD TWI

The dollar is currently in a zone close to overvaluation when looking at historical data compared to other currencies. Although recent declines have led to a slight recovery, there is still considerable room to continue this trend in the long term.

On the other hand, looking at the standard deviation calculated over the last 500 days, current levels are close to being oversold, suggesting a potential rebound. However, it is important to remember that this is a short-term outlook.